General Market Update

We don’t believe in timing markets perfectly or picking the bottom of the market– but we do believe that an informed buyer needs to understand volatility and how markets move and change over time. By doing so, customers take control of their purchasing decisions, instead of being at the mercy of others who have disproportionate access to information. We will provide you with a view of market changes directly in a periodic post. Today is the first of those posts.

The Wall Street Journal reported that natural gas prices are at 2-year lows now. In New York, low natural gas prices mean low electricity prices. The news on oil is all over the place– but in essence fuel oil shows no real sign of coming back in line with natural gas forwards, particularly given political issues in Iran. Bloomberg regularly has good, timely updates on commodities news and pricing.

We keep track, daily, of how wholesale prices have changed from one day to the next. You can view a forward curve graph on The Megawatt Hour’s dashboard. On The Megawatt Hour dashboard, the curve looks like this:

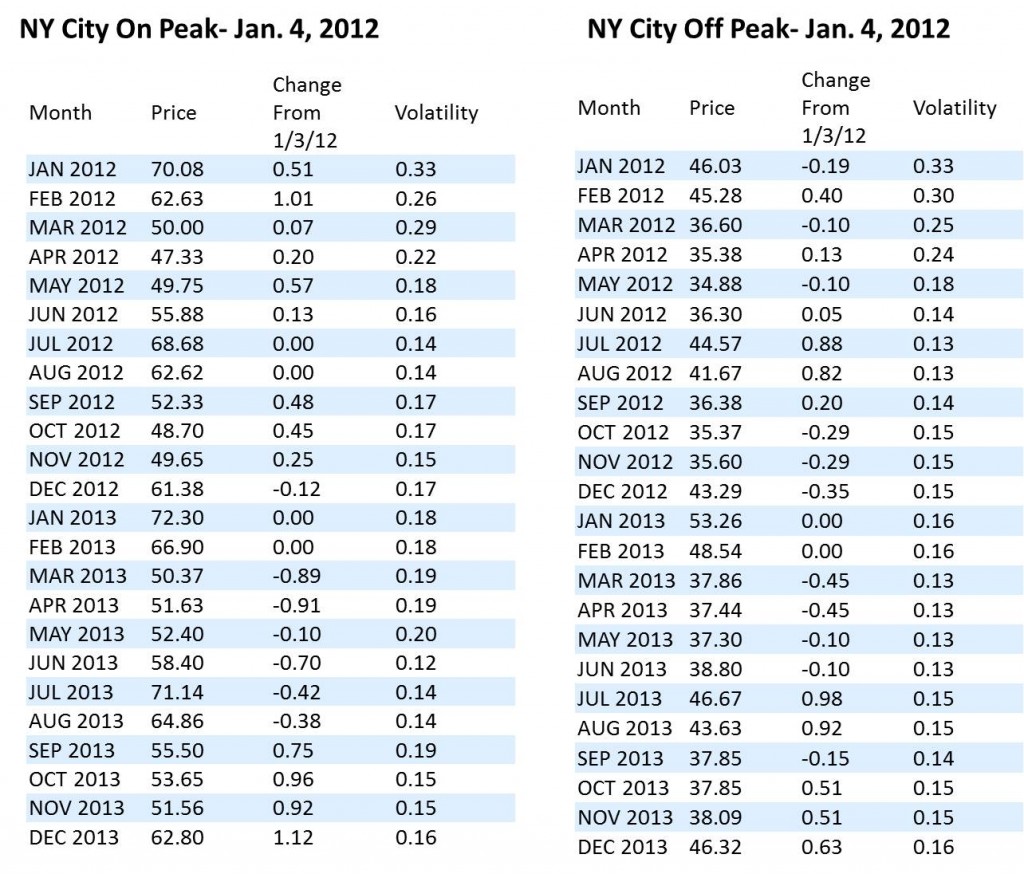

While electricity prices for 2012 have increased a bit from December lows, the markets remain low compared to historical prices. You can view how the market prices have changed from one day to the next (between Jan 3 and Jan 4) in the graphic below.

The key customer take away from this information is generally that you are better off negotiating a contract several months before your contract expires. It is more difficult to negotiate and maintain a lot of pricing and market options as you approach the month in which you are expecting your contract to expire. You are much better off beginning a negotiation with your supplier when you see a buying opportunity, rather than in the 30 days prior to your contract expiration. You have more flexibility and much more leverage. Notice the volatility and premium that you pay if you start a contract in February or March, compared to April or May of 2012. Also, if you are uncomfortable with a price or have the ability to hold off on making a decision, you can elect to go on an index contract with a supplier. That way you can wait to see how markets evolve before committing to a fixed price contract.

This information alone is not enough to make informed energy decisions, but it is a start.

Take away for customers

1) Electricity and natural gas prices are low compared to historical prices. If you are interested in buying a fixed contract, it makes sense to consider doing so now.

2) Never feel pressured. You have options.

3) Stay tuned in to the markets, even when you are under contract. It will give you much more power and leverage.

We’ll have another post on what these market prices mean to customers in the next several days.

For those of you who are interested in more detailed analysis and discussion of markets, here are some other resources

Long-Term Perspective On Crude Oil And Natural Gas Markets dated January 5, 2012 from Seeking Alpha. This article is targeted to investors primarily, but it offers in depth information and analysis on drivers of supply and demand.

Natural Gas The New York Times summarizes news and some analysis on various fuels and markets in the Business Day Energy and Environments Section. This information provides a helpful overview and updated analysis.

Oil Prices Predicted to Stay Above $100 a Barrel Through Next Year Analysts say higher global demand and possible supply problems from Iran could keep the price for a barrel of oil in the triple digits.