This post is the final one in a three-part series that delves in to the details of electricity products and pricing. The first post is found here and covers fixed price products (similar to your fixed rate mortgage): what they can do for a business, and how suppliers manage risk and exposure when pricing a fixed price product. The second post, here, covers index, or variable rate products (which is similar to your variable rate mortgage).

This post is the final one in a three-part series that delves in to the details of electricity products and pricing. The first post is found here and covers fixed price products (similar to your fixed rate mortgage): what they can do for a business, and how suppliers manage risk and exposure when pricing a fixed price product. The second post, here, covers index, or variable rate products (which is similar to your variable rate mortgage).

This post focuses on a hybrid of the two products: the index with block. We discuss the way the product works, what it can do for a business, how suppliers manage the index with block product, and what to look for when you request one. If you have already reviewed the first two posts in this series, you can skip to the last section in this post, which is called The Block, or Index with Block Product.

The Nature of Electricity

When people think about a product, they think of a good, a tangible item, something you can look at, touch, and see–especially before you buy it. Energy products, particularly electricity products, are peculiar in a number of ways.

- You only pay after you consume.

- You can’t see or touch it, you only receive the benefits indirectly– through a comfortable built environment, the right light output, motive power for your factory.

- While it is a physical good, it really only becomes a product through complex markets and financial management.

- In fact, what you pay is really determined by the fact that an electricity product is comprised of many products that get packaged into a single price, or rate.

- The element of time! When we talk about quantities of electricity a consumer buys, we have to take into account that it is really a flow of electrons over time. The time element is different from many other goods, but not unlike telecom products, for example.

Most energy buyers, even the most sophisticated among you, can get frustrated and confused by the details and the major determinants of an energy product. Electricity is electricity, right? Right. You can buy electricity on a variable or fixed rate – just like a mortgage. Or, you can buy some combination of fixed and variable rates. Finally, and again, like a mortgage, your purchase covers a set period of time. That time frame (start month and duration of the contract) will have an impact on your costs. HOW you choose to buy that electric power will determine your costs for the year.

Major electricity products

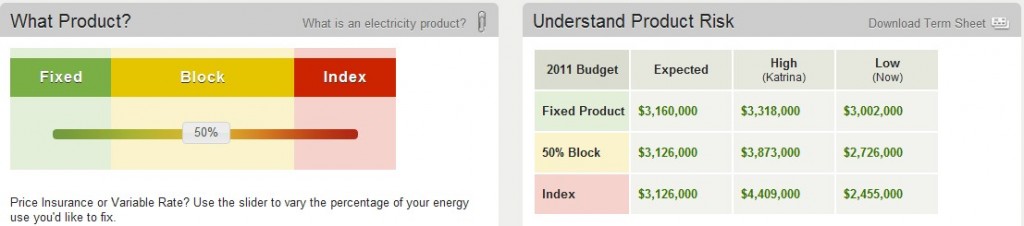

Here is a quick overview of all electricity products, before we get into the details of the block, or index with block product. The graphic displayed below shows you a section of The Megawatt Hour’s proprietary platform. On a daily basis, we update these cost forecasts. Our subscribers can evaluate the impact of an electricity product on their budget by dragging the slider in the graphic to the left and seeing the impact of fixing more or less of their electricity costs in the table on the right. In addition to viewing an annual cost forecast, subscribers can see how costs vary based on extremely high and extremely low cost environments– that’s what we call “The Stress Test.”

Block, or Index with Block Product

Essentially, the difference between the three products we’ve discussed is who bears the risk of market fluctuations–you, the customer, or your supplier. The block product is a hybrid of the fixed and index products– you are buying a portion of your energy requirements at a fixed rate. But because you are not asking your supplier to take on all the price and market risk, the premiums should be low. You are truly sharing the risk with your supplier. If the market is low during your contract term, you receive the benefit of that price decline in the cost of the remaining energy. On the other hand, if the market is high, that fixed component of your energy costs will dampen your exposure to higher costs.

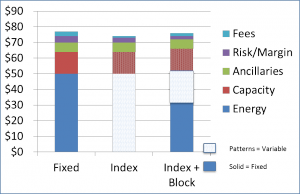

Purchasers of an index with block receive some price certainty by contracting for a part of their load in the form of a set amount of energy each month, and allowing the remainder of energy to float on an index. Usually, the customer will also pay a fixed adder for some components of their costs (known as the fixed adder). We describe the fixed adder in detail in the index post, here. Note that in the graph, above, the fixed components are depicted by the solid fills, and the patterns reflect the variable components.

The effect of this product on costs, as we mention above, is to dampen, but not eliminate, exposure to hourly energy price volatility. You can visualize that result by looking at the following graph:

Each of the fixed, index and index with block products have similar EXPECTED costs. Expected costs don’t tell the whole story. There are a range of potential outcomes during the course of a contract depending on the kind of product that you buy. You have to decide whether you need the full insurance that a fixed price provides, or whether you can accept some market cost variability. The index with block product may be the best of both worlds. This is especially the case if you have plans for operational changes at your facility that will reduce consumption at times of peak load. The index with block will let you see the greatest cost savings during high priced hours, but with less total budget cost risk.

What to be aware of when buying an index with block product

The biggest issue with an index with block product is that it is not widely available. In general, you have to be a large customer, with a peak load of at least 1 MW per month to get a supplier to quote you an index with block product. Most supplier pricing and billing systems do not have the capability to price or invoice smaller customers who want to buy a block, and so this may prevent customers from being able to buy the index with block product.

If this is the best product for you – and we would recommend it– we advise you to request a block product quote regardless of your peak load. The greater the demand from customers, of course, the more likely suppliers will be to offer these products. When you request an index with block, here’s what you should be aware of:

- Don’t “overbuy” the block– make sure the block quantity is not more than 50-70% of your peak load (at the most).

- You probably don’t need to fix any of your energy costs during the weekends or during the evenings and nights–don’t purchase block energy for those periods,so don’t buy an all-hours (or around-the-clock) block– buy on-peak only.

- Make sure the supplier’s billing system can handle the block invoicing, and that their invoices are straight forward to read and track. Ask for a sample invoice before you sign a contract.

- Make sure the contract gives you the flexibility to add other fixed price blocks of energy in future months.