Summary of Energy News headlines

Energy news in the last month of 2012 covered a range of topics. There has continued to be a lot of talk about the value of back-up generation in the aftermath of super storm Sandy. The first article that we review, titled “Backup Generators—How Much Are They Worth?” from late November describes ISO-based incentives that help businesses cost-effectively employ back-up generators. Next, there has been some interesting discussion lately on the impact of domestic natural gas production on the balance of power in fossil fuel markets (Source: Bloomberg). Finally, one of the biggest stories at the close of the year is the impact of the fiscal cliff on the US economy. If the US is further pushed into recession as a result of the stalemate, expect to see lower demand that, in light of high storage numbers, causes gas and oil prices to tumble. On the other hand, we’ve seen an indication that Winter 2013 will be back to normal or below normal temperatures, which could result in higher natural gas and electricity prices.

Backup Generators: How Much Are They Worth?

Backup Generators: How Much Are They Worth?

Jon Guerster, guest blogger on Greentech Media, raises the question of how best to evaluate the cost-benefit of a back-up generator, particularly for commercial real estate owners. He notes that investment in a back-up generator can be a difficult pitch to make during budget time. If the investment is entirely meant for business continuity, and it is virtually impossible to predict when the system will be needed/valuable (i.e. how many 100 year storms can we possibly have in 5 years?), then the facility person making that pitch may not have much luck making the case for investing in back-up capability. Ideally, commercial real estate companies can make the case by identifying alternative revenue streams for the back-up generator. Guerster describes a program funded by ERCOT (Texas’ ISO), he explains that ERCOT:

pays financial incentives for low-emission generators that can be added to their grid and controlled as a resource instantaneously, called “spinning reserves.” The added generation makes the ERCOT grid more reliable, which has a value that they quantify.

While low-emission generators are more expensive, ERCOT pays $150,000 per year for these systems, according to Guerster. In New York, a low-emission back-up generator can be deployed as a NY ISO capacity resource, which brings additional revenue for the generator, and can change the cost-benefit equation for companies.

Bottom line for Businesses: In evaluating the cost-benefit of a back-up generator, make sure you look beyond just business continuity concerns. Identify ways of maximizing the revenue potential for such systems.

Fracking Seen Robbing Opec of Gasoline Pricing Power

Fracking Seen Robbing Opec of Gasoline Pricing Power

The United States’ increased capacity to drill for oil and produce natural gas through hydraulic fracturing (known as “fracking”) could have a major impact on the balance of power in the global fossil fuels market, according to a report released in early December by the National Intelligence Council. The Council is an adviser to the director of national intelligence and publishes a report every four years to assist policymakers in their planning process. According to the report:

Rising domestic production from hydraulic fracturing is expanding U.S. supplies, which would shift the balance of power in global energy markets..In a tectonic shift, energy independence is not unrealistic for the U.S. in as short a period as 10-20 years.

The biggest obstacle to realizing the potential from fracking is lingering concern about the environmental impacts of the activity. The report indicates that closing loopholes and ensuring public safety from fracking is essential to realizing the potential of these resources.

Bottom line for Businesses: The most significant short-term impact of this information on businesses is the continued uncertainty around environmental regulation of hydraulic fracturing. Greater scrutiny, closed loopholes, while probably the correct policy decision, could result in higher cost to extract natural gas and may result in price increases during 2013-2014. On the other hand, greater energy independence in general, and a less global fossil fuel market (and less interdependence) will ultimately benefit US businesses.

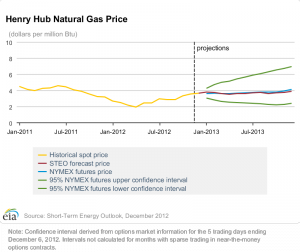

What is the future for natural gas (and electricity) prices?

Natural gas futures rose for the second consecutive week last week– all on speculation about a cold start to the month of January. The EIA’s Short-Term Energy Outlook reports:

Gas prices will be higher in 2013 as more normal demand in the heating season from November through March erodes stockpiles that ballooned last winter…

We may see prices bump up on cold- or normal weather during the heating season. On the other hand, we also expect to see continued expansion of drilling capacity, and, keep in mind, we are at all time high stockpiles. Much of the recent price increases may be based on speculation and on expectations of trading profit.

Alternatively, the fiscal impasse could result in a dampening effect on demand if there is no political agreement and if the impasse it results in extending or deepening the US recession, see article, here.

Bottom line for Businesses: Expect greater price volatility in natural gas and electricity in 2013. We are starting at a relative low, so there really isn’t anywhere else to go, but up