Here is a run down of the major energy stories of 2012– as we see them. We selected these stories because we believe they are the most relevant to commercial and industrial customers that buy energy in deregulated markets. We also provide you with some thoughts, not predictions, on what all this may mean to you in 2013.

Low prices: Natural Gas and Electricity

Low prices: Natural Gas and Electricity

Natural gas and electricity prices hit all time lows in 2012. That means that customers who bought power or gas at almost any time in 2012 looked heroic. You beat your budget forecasts.

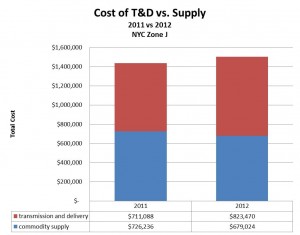

The other interesting thing to note about 2012 (that was a result of these low commodity costs), as we reported here, is that transmission and distribution (T&D) costs were higher than supply costs for the first time since deregulation began in the late 1990s. Energy and facilities managers found themselves focusing on how to manage T&D costs with as much effort and scrutiny as they had managed supply costs in the past.

All of this was great news for 2012, but what does it mean for the coming year? For those of you who use your last 12 month numbers as a forecast for 2013, you may find yourself on the wrong side of those numbers this year.

EIA expects the Henry Hub natural gas spot price, which averaged $4.00 per million British thermal units (MMBtu) in 2011, will average $2.78 per MMBtu in 2012 and $3.68 per MMBtu in 2013.

What does this mean to businesses in 2013?

- Don’t expect prices to stay at these all-time lows. As you can see from the EIA numbers, they probably won’t skyrocket.

- In order to create accurate budget numbers, it is best to use forward forecasts of costs, rather than looking in the rear view mirror. The Megawatt Hour’s budgeting and forecasting capability provides accurate, current, market-based forecasts of costs, and reconciles budget forecasts to actual expenses as the year progresses.

A Focus on Accountability and Transparency at the Wholesale Level

FERC issued a record penalty to an energy supplier/trading shop in 2012, claiming that Constellation manipulated New York energy markets in 2007 and 2008. The FERC promised continued scrutiny of power and gas trading operations.

What does this mean to businesses in 2013?

Continued scrutiny and, ultimately, transparency about how suppliers and retailers make money only benefits businesses. There may not be any immediate, short-term or tangible gain to businesses, but it should give you greater confidence that you are operating in a fair market when you buy gas and electricity in deregulated markets. Furthermore, as you use The Megawatt Hour’s service, and get greater visibility into forward market moves, supplier pricing models, and pricing comparisons, you will be far more confident that you are getting the right price, a good price, on your electricity contract.

Storms and disruptions

Storms and disruptions

Of course, the biggest story in the latter part of 2012 was Hurricane Sandy, which hit NY and NJ (and had an impact all along the East Coast) on October 29th. The implications for businesses included: business disruption, loss of revenue, increased expenses due to increased fuel costs, and property damage, among many others. Now, the question is, what impact will Sandy’s aftermath (as well as a forecast of more frequent storms) mean to businesses?

What does this mean to businesses in 2013?

There are a range of issues and potential issues that businesses may have to address. Here are two:

- Back-up generation. Does it make sense to invest in more robust back-up generation capability? There have been some interesting, cross-cutting discussions of this topic. In an era in which many people can work remotely, having a building close for a few days is probably not a significant problem. On the other hand, if you can find additional revenue to help fund the installation of a low-emissions back-up generator (i.e. a capacity program, payment for ancillary services) perhaps it is a wise investment and will set your building apart from others.

- Cost of infrastructure improvements. Utilities have always been under pressure to keep rates as low as possible. Some utilities have deferred maintenance; none of the utilities in NY or NJ ever really seemed to consider implementing measures to deal with potentially catastrophic events like Hurricane Sandy: they were too difficult to predict and costly to integrate into the planning process. A recent article in The New York Times discusses the trade-offs between investment in prevention and the cost of recovery. The articles states that:

Traditionally, utilities have focused largely on tree-trimming and sandbags to ease storm damage, and politicians and regulatory commissions have discouraged spending to protect against what seemed to be the long odds for catastrophic storms.

While it is unlikely that rate payers will bear the burden of recovery costs (although it isn’t absolutely clear yet), there may well be additional rate payer costs if utilities get approval from regulators for investment in preventative measures. Most of the information available about the future of severe weather events (largely compiled by the insurance industry) is that severe weather will continue. Bottom line? We haven’t seen the last of our 100 year storms.