Summary of Energy News Headlines

Economic news and energy clearing prices in New York dominate current headlines. Today we are focusing on:

- a quick summary of January prices in New York State. Why are they so high? What does this mean to businesses?

- the closure of a nuclear power plant in Florida. This decision may have implications for power development and forecasts for other markets; and

- economic updates that may signal the direction of market pricing.

What happened to New York’s electricity and capacity prices in January?

Those of you who are on a variable rate in New York state (or on Con Edison’s supply rate) will find yourselves experiencing significant sticker shock when you receive your January invoice. January day-ahead energy (on which variable rates and Con Edison’s rate are based), were far higher and more volatile than they have been in at least a year. Day ahead on-peak prices in New York City were 90% higher in January than December prices and were higher than even the market seemed to anticipate only weeks before.

Here are a couple of examples of what we mean by high prices:

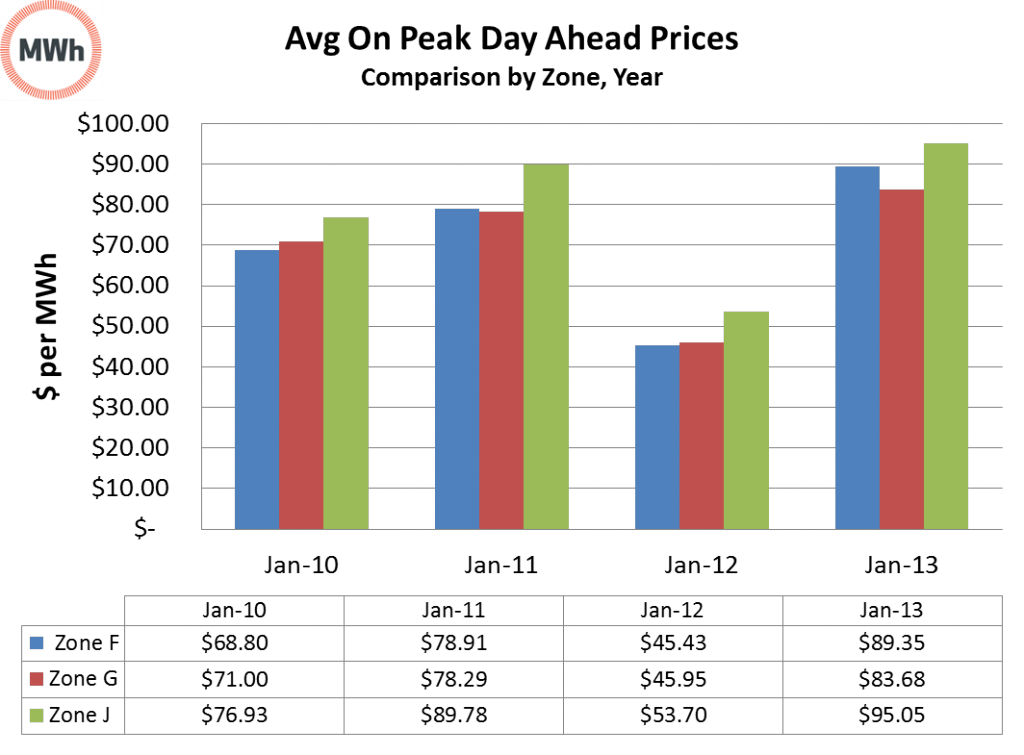

- January day ahead prices settled very high for Zones J (New York City), F (the Zone near Albany, NY) and G. The average on peak day ahead price for Zone F was $89.35; average OFF peak was $71.97. By comparison, zone J (NYC) On/Off was $95.05/$68.77. For the period Jan 23 – 28, the zone F average (all hours) was $164. The January clearing prices in many respects are a return to “normal” energy prices. Perhaps the biggest challenge for customers is that the market has enjoyed lower than normal prices over the last 12 months. Take a look at the following graphic, which illustrates this point:

- Capacity* (see definition, below) prices outside of New York City were also higher than they have been. Winter 2011-2012 average capacity prices cleared at about $0.21/kW/month, far lower than the winter capacity prices for 2012-2013, which have averaged $2.19/kW/month through February 2013.

Why? And what do these spikes mean to you?

One possible explanation is a plant closing in Zone F. In mid-December, Dynegy Holdings announced the sale and permanent closure of its Danskammer power plant, located near Newburgh, New York. The 493 MW coal-fired power plant, which was apparently damaged during Superstorm Sandy, is being sold and will be de-commissioned. While the closing of a power plant is a significant event, all indications suggest that there is no shortage of power generation in New York State. According to the NY ISO, the state has a generation capability of 44,754 MW and projected peak load of 24,832 MW expected for Winter 2012-2013.

Another possible explanation is the colder (but not below-normal) weather that the Northeast experienced in January. Colder weather results in increased natural gas storage withdrawals, lowering the gas reserves and therefore driving up electricity prices. Weather would not, however, have an impact on the cost of capacity.

While we don’t know exactly what is causing these higher prices, we are keeping an eye on these developments and will let you know if these trends continue through the month of February.

Bottom line for Businesses: If you are on a variable rate for electricity (or you are on utility supply), you will see higher prices for electricity than you may have budgeted and/or than you would expect. In addition, you may see this for the rest of the winter (the month of February at least). Prepare your financial decision makers for higher costs for the month of January and, quite likely, into February.

While the day ahead and capacity prices were high in January, the forward market continues to be reasonable for summer 2013; while Winter 2013-2014 has increased. If you are concerned about volatility, fix your price now for the Spring, Summer and Fall, and keep a close eye on Winter 2013-2014 forward prices.

Right now, you can use The Megawatt Hour’s transaction module to get fixed price quotes at no upfront cost. If we don’t get the best possible rate for electricity, you don’t pay us.

Retiring a nuclear facility in Florida.. and what it means to the rest of us?

Duke Energy announced plans to permanently close the 860 MW Crystal River nuclear plant. The plant has not been operating since 2009, when the company began relatively routine upgrades to the plant that went awry (and resulted in a crack in the containment building). The plant’s decommissioning will take place over a period of 40 to 60 years so as to stagger the financial impact of mothballing the plant. This announcement, along with others that signal closings or reduced investment in nuclear power in the US and abroad have raised questions about the viability of nuclear power. A blog post by David Biello in Scientific American explores this topic.

Bottom line for Businesses: The US nuclear infrastructure is aging, and costs to replace and upgrade these facilities are significant. New nuclear construction takes a long time, and is often not cost-effective. Low gas prices may favor investment in new facilities that are gas-powered. The construction of gas-fired plants may offset the downward price trends seen recently– caused by the promise of shale gas. Businesses should watch the forward market for power which is driven largely by expected gas prices. Low forward prices seen over the past year (or so) may not persist very long.

Economic indicators… what do they mean for energy markets and business?

There are several indications that the economy is on the road to recovery. According to this article in BusinessWeek: homebuilders are backlogged and the stock market is not far from a record high. In addition, Business Insider cites a Congressional Budget Office report that indicates that long term drivers of the deficit are also improving. This is all good economic news.

Bottom line for Businesses: Good news for the economy can mean bad news for commodity prices (from your point-of-view). Expect natural gas prices to continue to rise, along with electricity prices in most markets.