Summary of Energy News Headlines

Energy clearing prices in New York dominate current headlines, along with news from energy company, Hess Corporation, to their shareholders announcing their intentions to close their retail business. Today we are focusing on:

- a quick summary of January and February prices in New York State. What has happened since we last reported on these price spikes? What should businesses look for going forward.

- Hess Corporation’s decision to close their retail business, along with other downstream businesses.

Where did New York energy and capacity prices end up in January and February?

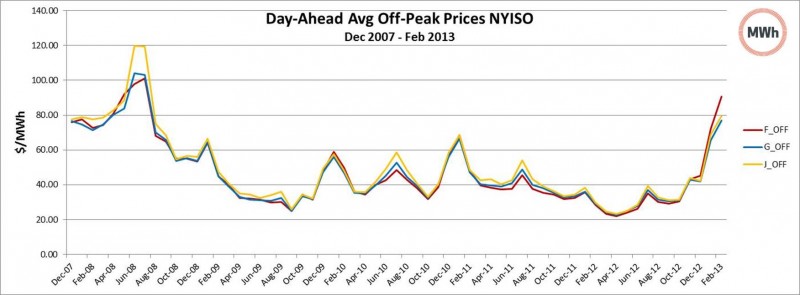

The big story this Winter, as we discussed here on February 7th and February 14th, were much higher-than-expected energy and capacity prices in January and February 2013. To put this in perspective, on-peak prices in February 2013 in Zone F closed at an average of $109/MWh– 114% higher than the day-ahead on-peak prices in February 2012. Zones G and J were also significantly higher than last year, and far higher than December 2012 prices. You can see how day-ahead energy prices cleared in the following two graphs– which track the day-ahead average prices by month since December 2007 through February 2013. These graphs give you a visual sense for how extreme these recent clearing prices were, closing higher even, than the summer peak periods.

Capacity prices have also been higher than recent historical prices. Outside New York City, capacity cleared at $2.02 for March ($/kW/month of UCap) down from $2.80 in January, but way up from $0.36 to $0.11 last Winter. New York City capacity prices closed roughly $1.00 higher than last Winter. (For a definition of capacity and how it is calculated, view The Megawatt Hour’s Resources section.)

Bottom line for businesses: If you have any exposure to index (or day-ahead) prices or have chosen in the past not to purchase capacity in the forward markets, your 2013 budgets will be hit, and hard. Our advice is to make sure your finance people are not surprised. And then put a plan in place for the next 12 to 18 months. The good news is that forward markets do not reflect these price spikes. The forward energy market continues to be a relative bargain (compared to historical prices). If you see a price that allows you to meet your budget for your next contract term, don’t wait. We should see purchasing opportunities between now and May, 2013.

No More Retail for Hess Corporation

Hess Corporation today announced their intentions to exit the retail energy business so they can focus on lower risk, higher return businesses. It is not a surprise, because the Company had indicated that it wanted to transition to a pure production and exploration business. However, it is a loss to the retail energy industry. Hess was a long-time (primarily regional) retail energy player. While we never endorse suppliers, we found that our clients who worked with Hess were generally happy with their service: clients reported that Hess provided a good mix of product offerings, they were price competitive and very competent at executing on their commitments to customers. This exit is a loss to the retail business. We would expect that Hess will seek a strategic purchase of their retail business and, it is expected, would announce an agreement to sell the business shortly.

Bottom line for businesses: While we are still awaiting confirmation from our Hess retail contacts, we expect Hess to honor their retail contracts. We would expect Hess to divest its retail asset: this can cause upheaval. But if you are in the middle of a contract, you should continue to receive service from Hess, and the successor company, through the end of your contract. The bigger concern is whether you will get the same sort of competitive pricing from its successor company or from any other retail suppliers now that a major competitor is exiting the business.