We’ve been getting questions about how markets have changed and what is different between 2012 and 2013. Many businesses are working on their budgets now for 2014, and it seems you want to know whether your costs will be more like 2012 or 2013?

The bottom line is that stability and predictability in energy markets ended in January 2013. Volatility returned to index (day-ahead) prices during the Winter months (January and February) in New York and New England. The increases were notable, for example index prices reached all-time highs in Zone F, the Capital region of New York. As soon as day-ahead prices moderated, in March, capacity prices spiked and have not dropped since that spike (for various market and regulatory reasons). The good news for businesses that buy power in deregulated markets is that natural gas prices remain low, and therefore the forward markets favor the buyer.

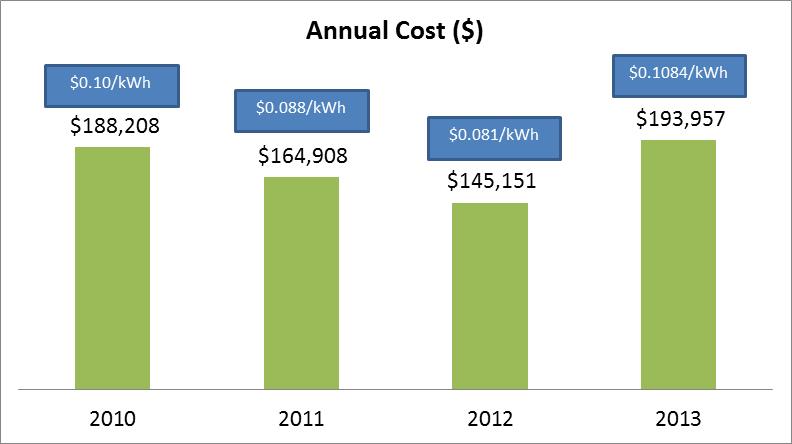

As you think about your budget process, consider the experience of prior years. Here’s an example. Take a look at the total electricity supply budget and unit rates for the following building—it is a 2 million ft2 building in Zone J, New York City. The following graph shows the costs (total and unit cost) for this building if it had remained on an index product from 2010 through 2013. 2013 numbers include actual costs through August and forecasted costs based on today’s market prices through the rest of the calendar year.

What should you do if you’re trying to budget for 2014?

This graph shows the risk of using the prior year’s costs as a forecast for next year’s budget. The best approach to budgeting for 2014 is to use actual forecasted market costs to develop your targets. When you use actual numbers and market rates to forecast, you:

- Are less likely to make a significant mis-step (for example, if this building had budgeted for 2013 using the average of historical costs, they would have been “off” by 17% –$28,000);

- Use best available market data, which is updated as market circumstances change—and then you can explain what is different as you move through the budget year;

- Are better able to execute a supply contract that meets that budget—it isn’t just a pie-in-the-sky number. (First you forecast, then you can execute based on that forecast, instead of just crossing your fingers and hoping for the best.) By using market data, you’re more likely to get a price that is in your target range when you go out to purchase electricity or gas.

If you need a budget forecast…

We can turn budget forecasts around in 24 hours.