Today a Bloomberg article titled “Eastern U.S. Power Gains as Warm Weather Drives Use” explained the real time/day ahead price spikes experienced in the Northeast and New England today. Thanks to unseasonably warm temperatures, New England and New York are seeing what will likely be temporary real time price spikes. As the article explains:

Power prices from Boston to Washington advanced as warm weather swept through the region, triggering consumption to run air conditioners during a period when power plants are undergoing seasonal maintenance.

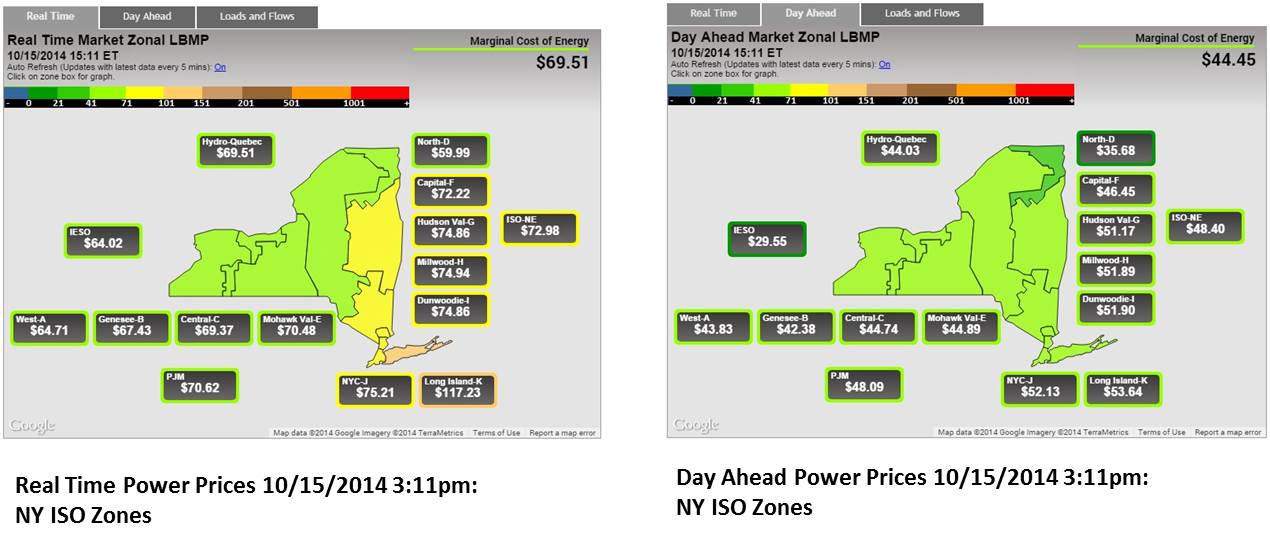

If you take a look at the two maps, below, you can see that the difference between day ahead and real time prices is about $25.00/MWh for this particular hour, that amounts to $0.025/kWh–the difference between paying 7 cents and 9.5 cents/kWh.

Don’t Panic

This kind of spike will only impact you, as a customer, if you are taking a real time power product from a supplier, which is rare. If you are a demand response customer, there is a chance you will be called to curtail if this persists.

For the rest of you, this kind of volatility will only impact your supply bill if it starts to have an impact on day-ahead or forward markets. This is only likely to happen if the warm weather continues during these planned plant outages.

These are “mature” markets, why does this happen?

There was an article in the Harvard Business Review blog, also posted today, titled The Dark Side of Efficient Markets. In short, author Roger Martin explains:

In the natural evolution of markets, as markets become more efficient, they turn from being use-driven to expectations-driven — like equities, real estate, or derivatives based on both.

For this reason, the unintended consequence of efficiency is price volatility…..

Efficient markets move for two reasons, according to Martin, “expectations are boundless and extend far into the future”. Energy markets are probably not perfectly efficient– information doesn’t flow freely between buyers and sellers. Nevertheless, there is no doubt that expectations and emotion impact energy markets. For example, the Polar Vortex, one of the principle stated reasons for the market run-up last Winter, is behind us. And yet, forward prices for this coming Winter are almost double what they’ve been in years past. That’s bound to be expectation and emotion.

Bottomline for businesses: Look for continued spikiness and volatility in energy markets. Learn to manage through volatility. As an informed, efficient market participant, you should be able to use volatility to your advantage.