Volatility in electricity markets in the Northeast has reached extremes. Take this example: Between Friday and this morning, on peak prices for January 2015 dropped $11.00/MWh. That’s dramatic. To paraphrase Yogi Berra, if you don’t like energy prices, wait 5 days.

What’s happening?

Weather. And perhaps some trading opportunities.

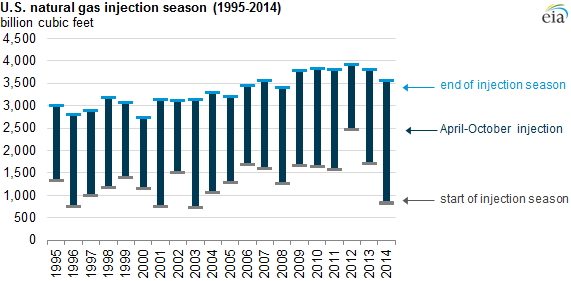

As this EIA graphic so brilliantly illustrates, the natural gas injection season was one for the record books.

So, as a result, we begin the heating season with a comfortable storage reserve. Now, the market is simply looking for direction and responding to any signals and hints of a cold Winter.

The facts remain– New England’s power and heating markets are highly dependent on natural gas– and pipeline capacity is limited. On the other hand, each time we receive a hint of warmer than normal temperatures, we see significant market declines…

Bottomline for businesses: What does this mean for you? Make volatility work for you. Don’t wait around until the perfect time to buy… take advantage of buying opportunities when you see them. Smart buying results in cost reductions of 10% or more when compared to waiting until 30 days before your contract term ends.