As we mentioned in our first two posts in this series, when we poll energy managers about their biggest concerns about energy, the responses are “controlling costs”, “managing out-of-control costs” or a general concern about “rising costs”. There is always a concern that energy costs are completely out of control, and are impossible to predict and manage. That doesn’t have to be true.

The Megawatt Hour has developed a three-step process that delivers this key result: predictable, reliable energy expense management. We explained the first two steps in the process in two previous posts. You can find out about the first step “IlluminatedInfo” here and the second step “MarketFocus” here.

Step 3 in the process requires customers to be proactive and act quickly. In order to get predictable, reliable results, you must be in a position to act quickly, and at any time: Step 3 is called MarketAction.

What’s the problem?

There are a number of challenges in managing energy costs. For example, it can be a challenge just to assemble and manage basic energy information (which we covered in Step 1 of this process). It’s also hard to get good, unbiased information about energy prices and markets (which we covered in Step 2 of this process). But even with these two challenges taken care of, to get results customers also need to be in a position to act quickly at any time during your contract term.

What kind of action are we talking about? In a word, “procurement”. Because energy markets are volatile, and because they allow consumers to enter into multi-month and even multi-year contracts (sometimes up to 3 years or more), customers need to be able to extend, alter, or terminate existing contracts (whenever possible), and/or enter into new ones at any point during their contract term. This ability to move quickly when energy market opportunities present themselves is the third key capability for the successful energy management process.

The problem is that most customers do not have access to market information that allows them to act quickly and decisively. As one CFO put it “we are always flying blind.” What key information are they lacking?

- First, customers rarely, if ever, receive any concrete price signal that suggests that there is a purchasing (or contract-extending or contract-restructuring) opportunity. We have seen it many times: a customer is not aware that there have been several options to purchase at or below their current contract price (or their budgeted price) until after the opportunity has passed. By the time they’ve dusted off their contract and begun what seems like a laborious process to get a new contract signed, it’s often too late.

- Second, customers often don’t have the historical or forward-looking context within which to evaluate a price signal, if they do get it.

- And finally, even if they have both the pricing information and a sense for the market context, they don’t have any guidance, decision rule or process that helps them to combine these two into a decision to act (or not to act).

The accumulation of these issues is meaningful for finance professionals and energy managers, because when customers buy is typically as important as what product they buy, or how they buy it.

So we’ve identified all the potential barriers to taking appropriate market action, and we’ve made a case for the importance of always being in a position to take market action. But we haven’t outlined our view of how best to actually . . . act!

The actual act of entering into a new contract (or restructuring an existing one) is probably best handled in a separate post. Our goal here is to outline the best practices and necessary ingredients leading up to the decision to take action. Once the decision is made, the action itself quickly becomes routine, and we will have another blog post soon that describes concrete steps involved in the act of procurement, which may be helpful for those who haven’t done it before.

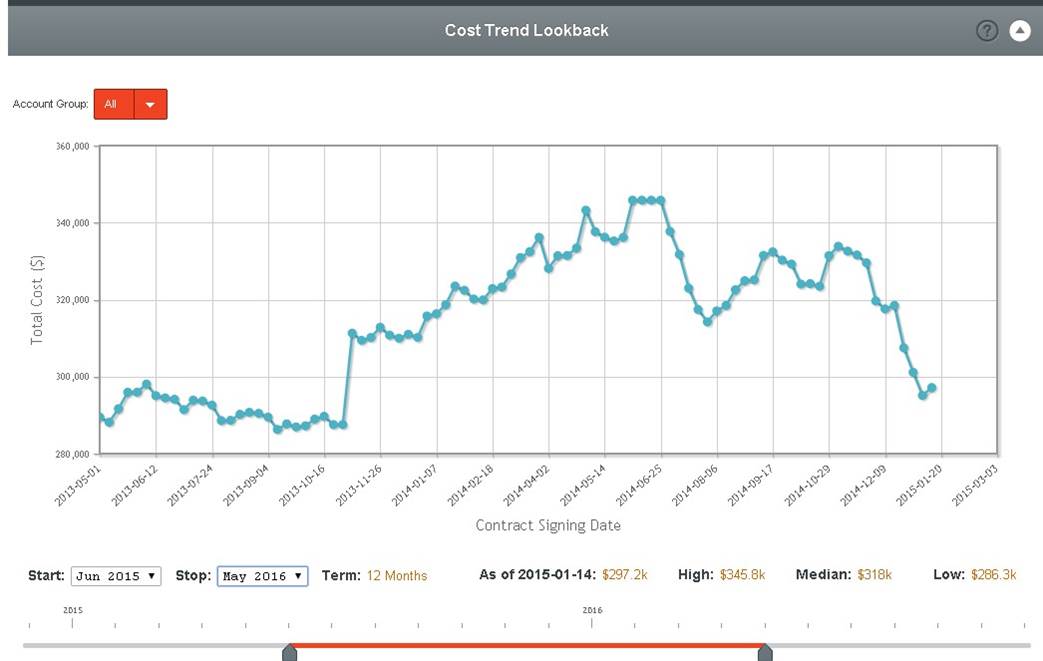

To be in the best position to make a good decision and to take market action, customers ideally need to make the most of market opportunities. The graph, above, shows how the cost of one single contract term changes thanks to market movements. As you can see, during the course of one 12 month period there are at least 4 significant buying opportunities. How do you manage to make the most of those procurement opportunities?

- Have regular, daily or weekly (yes, we mean that regularly) access to accurate prices for the energy market(s) and contract types that are relevant to your business. This ensures that you have access to the price signals you need in order to make decisions about acting (or not acting) in the markets.

- Develop a set of internal pricing benchmarks that, if prices reach them, signal that you should then follow your process for deciding whether or not to take action. For example, one potential benchmark could be when prices for a certain contract type and term are lower than a contract you currently hold. Another example of a meaningful pricing benchmark could be when a particular contract price produces a budgeted cost that is 15% below your current budget for the coming fiscal year. Whatever the benchmarks are, by developing them in advance you have in effect already done some of the work required to evaluate a market opportunity. This means you don’t need to start this kind of thinking from scratch when you get a favorable pricing signal, or an urgent call from a broker or supplier.

- Develop a process that ensures you will be notified if your pricing benchmarks are met or exceeded. This ensures that you actually get the price signal if it arrives, even if your daily (or weekly) discipline about checking the markets is less than perfect.

- With historic and forward-looking data in place, we recommend that you solicit input from energy market participants you trust, before making a decision to take action. These could be brokers, consultants, suppliers, or other experts.

- Document how you came to a decision. This is an important part of a responsible procurement process. Write down what information you considered, what pieces were critical in cementing your decision, and how you expect (or hope) the decision will impact your energy costs. This information will help you explain your decision to any interested stakeholders, and prevent you from forgetting or losing any of the elements of the Market Action decision. It can also help you to refine your decision-making process over time, help you train new people or other colleagues in energy procurement, and help you hold experts and consultants accountable for results over time.

This list of recommended steps leading to Market Action may seem detailed and extensive. Decisions are difficult, transactions are easy. In fact, with the right process and the right information, decisions are clear and straight forward– in essence, the right decision path becomes very clear and very easy to justify. But there’s some upfront work to be done.

Energy procurement decisions can be difficult, and there’s a lot of information that can be considered, no doubt about it. But by following these steps and putting these processes in place, you’re front-loading a lot of the work involved. This frees you up to act quickly, and gives you a foundation from which to continue to build and refine your process, leading to continuous improvement in Market Action decisions. And, it gets easier every time.

Not only that, but this road map makes sure that you’ve got charts and graphs and outside opinions that support your decision to help address any Monday morning quarterbacking that may come your way. As we’ve said before, CFOs love to see results like these. You can point to the data you had when you decided it was the right time to buy. You made the best decision with the information available to you. Well done.

Bottom line for businesses. With the right information, it takes minutes to act on market insights. Those minutes can be worth 15-20% savings to your business.