There is a great deal of buzz in the energy world about the potential for energy storage. Venture capitalists are swarming, trying to find the right play; Elon Musk and Tesla have launched a residential storage technology they call Powerwall; pundits are writing about a utility “death spiral” if on-site generation and storage become widespread enough to “strand” the investments made in the electricity distribution infrastructure; cats and dogs are sleeping together! The level of discussion around this issue led us to ask what is driving the buzz and how relevant is it to businesses and institutions right now?

Let us begin with a disclaimer. We are not energy technology experts. Our expertise is in retail energy markets and information software. Our interest in the topic is framed by our interest in bringing transparency to empower buyers of energy. Here are a few articles that we found helpful in understanding the dynamics and potential for energy storage.

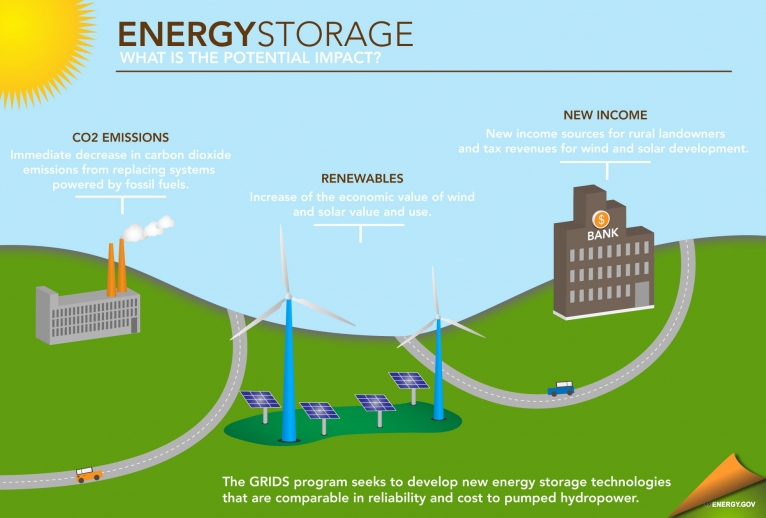

Source: US DOE energy.gov

Why Storage?

First, what’s driving the focus, buzz, investment and general interest in energy storage? This didn’t use to be a “thing.” But now it is. The declining cost of energy generated by renewable resources, like wind and renewables, means that more of the electricity delivered to the grid is intermittent, and not generated by fossil fuels which are steady, reliable “base load” resources. The focus on reducing the carbon footprint of industrialized and emerging economies suggests that growth in renewables will likely continue.

According to an article in Utility Week on the storage economy,

One obstacle to the functioning of the electricity market has been the absence of cheap, efficient and reliable storage, which would enable the grid to be balanced by absorbing excess or off-peak energy for peak time distribution. The integration of more wind and solar will put a strain on baseload generation. As renewable penetration increases, demand for baseload generation will decrease throughout the day until it goes below the minimum needed for plants to stay online, resulting in operators having to switch them off. But when solar and wind generation drops, there is a steep ramp up in demand and the baseload is required to come back online.

Get informed about the dynamics and economics of energy storage (Why Energy Storage is About to Get Big and Cheap) by reading a series of posts by Ramez Naam, who writes and lectures extensively on energy and technology.

How will storage integrate into markets?

Second, if these dynamics continue, what are the implications for large end users? What needs to happen to make the promise of storage a reality? Competitive markets, when working well, present a great opportunity for integrating energy storage into the customer supply chain. Customers who are able to receive more frequent and market-based pricing signals will be motivated to employ a range of technologies to control and lower energy costs. Ideally, large users will one day have the opportunity to make the following determination:

Is it more cost effective for me to…a) buy electricity and power from large, investor-owned utilities? b) to invest in a combination of on-site generation, renewables and/or grid storage, c) invest in energy efficiency and renewables in a cost effective way? or d) a combination of all 3? It seems so simple, and, hopefully, some day it will be.

As Naam writes:

What really matters when we talk about energy storage for electricity that can be used in homes and buildings is the impact on Levelized Cost of Electricity (LCOE) that the battery imposes. In other words, if I put a kwh of electricity into the battery, and then pull a kwh of electricity out, over the lifetime of the battery (and including maintenance costs, installation costs, and all the rest), what did that cost me?

The utility of the future will likely include advanced storage technology. In order for large users to make sound decisions about storage investments, there must be clear, transparent pricing mechanisms (at the utility level– time of use rates, etc.) that permit large users to evaluate the best way to meet their electricity needs.

Bottom line for businesses: Energy storage technology is growing more cost-competitive and may prove to be a viable electricity supply option for large users. Keep an eye on this technology. In order for customers to take up storage as a supply/delivery option, pricing and costs must be transparent and market-based.