We have heard from partners and customers across NY state this week who are expressing concern about energy price volatility reported in the news. Let’s put this week’s energy price volatility in perspective.

It is true that, as Bloomberg reported, power prices shot up over $1,000/MWh yesterday. Bloomberg also reported (and Crain’s re-printed) news of snow storms in Upstate NY that also cranked up demand upstate and down. The region experienced colder weather starting Monday of this week. As a result, heating degree days on Monday (38) and Tuesday (45) were almost double the prior daily readings.

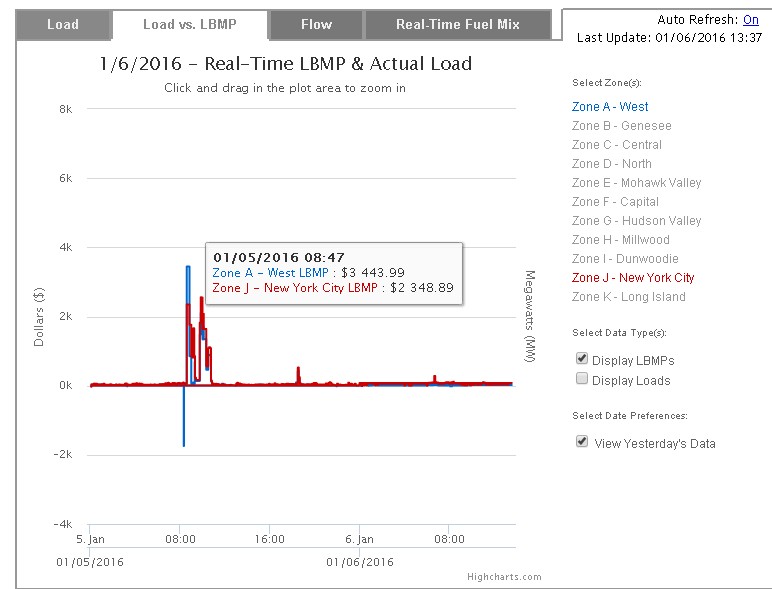

The high prices reported by Bloomberg occurred in the real time markets, not day-ahead markets. Day ahead index markets in the Western Zone for Tuesday were $38/MWh on peak, $25/MWh off peak. In NYC, day ahead prices for Tuesday were $49/MWh on peak and $35/MWh off peak. Real time prices on Tuesday averaged $140/MWh around the clock in NY West with hourly prices exceeding $3,000/MWh at times. In NYC, real time prices averaged approximately $170/MWh with many hours coming in over $1,000/MWh. Not only that, but the extremely high prices occurred for only a few hours in each market, as you can see from the graph comparing the hourly real time LBMP in the West Zone and in NYC.

Bottom line for businesses and institutions: When you take a closer look at pricing, it is clear that it is too soon to panic. The high prices reported by Bloomberg occurred in the real time markets, not day-ahead markets. Also, the high prices did not persist throughout the day– they were confined to a few hours. Most energy buyers will buy power in the day ahead markets. Default service (the costs billed to customers who do not select an ESCO or retail supplier) is based on the day ahead market price. Day ahead prices remain low, although volatility in the Winter months has a 2 year precedent, so it is always wise to keep an eye on pricing.

On a cautionary note, the fact that a burst of normal to cold(er) weather caused volatility at these levels suggests that these markets are looking for bullish news.