Customers have asked us what is going on with natural gas and electricity markets these days. Since April 6, there has been a rally in gas and electric markets. The impact of that rally on your power and gas costs will depend, a bit, on your current contract terms and requirements, your usage profile and your capacity obligation. (For definitions of all of these terms, take a look at the Resources page.)

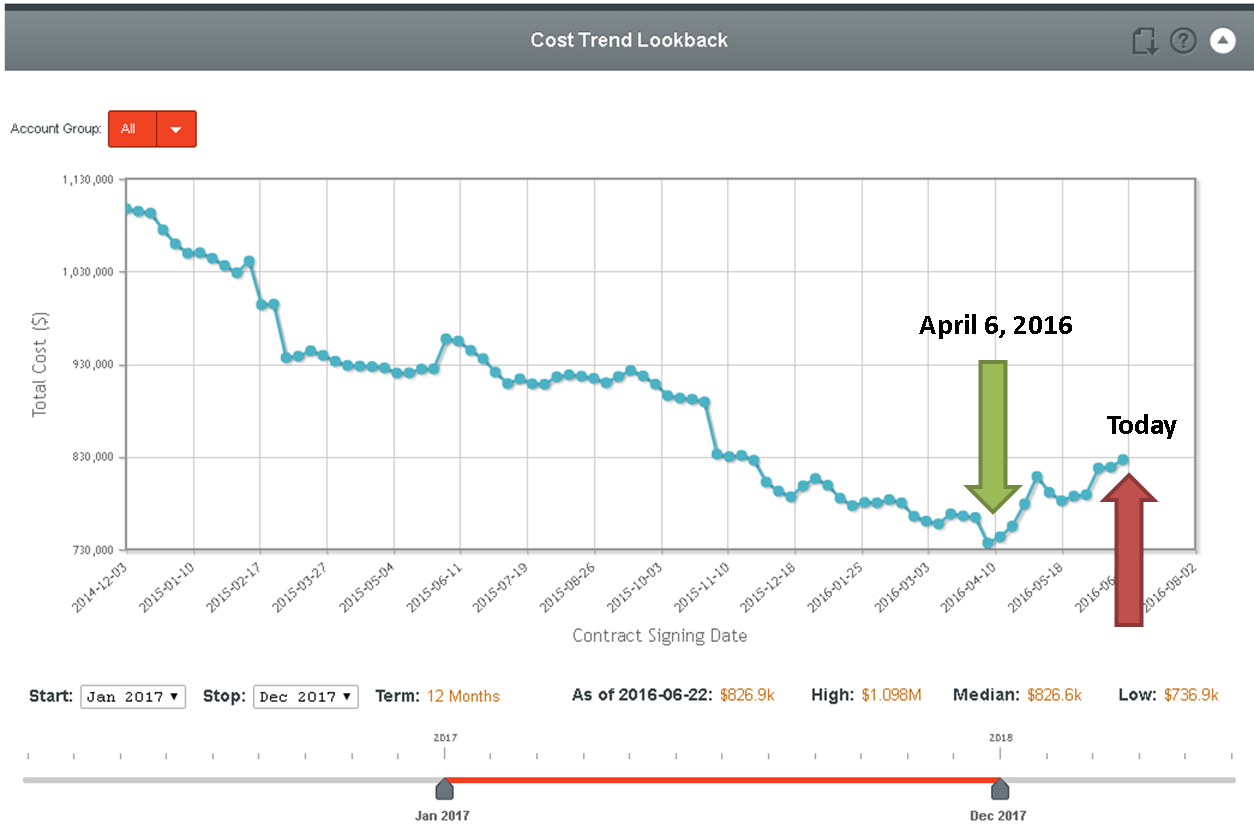

Here is an indication of what has occurred in energy markets since April 6, and the impact of market volatility on costs.

This chart shows contract costs for the same time frame, Calendar year 2017, for a residential property in  Zone J, New York City. You can see how contract costs have moved over time — our software plots the weekly market movements from December 2014 through to today. You will see that the historic low occurred on April 6, 2016 and that since then fixed price electricity costs have increased 12% from $737,000 to $826,000. This increase is driven by an increase in forward markets for energy and will affect clients who choose to purchase any of their gas or power in fixed quantities (whether you buy a block of gas/power or whether you fix 100% of your load).

Zone J, New York City. You can see how contract costs have moved over time — our software plots the weekly market movements from December 2014 through to today. You will see that the historic low occurred on April 6, 2016 and that since then fixed price electricity costs have increased 12% from $737,000 to $826,000. This increase is driven by an increase in forward markets for energy and will affect clients who choose to purchase any of their gas or power in fixed quantities (whether you buy a block of gas/power or whether you fix 100% of your load).

So what do we do?

We have seen a fairly dramatic increase in gas and electricity prices over the past 8 weeks. If you have the option of sitting out of the market until later in the summer (late July, early August), you may see some relief from this volatility. No guarantees, but if you have time you might want to wait and see. It bears repeating: There is no guarantee that we will see the low prices that we’ve experienced this winter and spring.

We are still near historic lows for gas and electricity. If there is a price that works for your budget, and you need to ensure price certainty, then perhaps you should proceed. This is particularly true for customers who have contracts coming up for renewal in the near future.

Bottom line for businesses and energy buyers: In general, it is best to be prepared to act on market movements quickly, so you don’t miss opportunities when markets move.