We continue our series in which we answer common client questions. This post is an introduction to electricity products, specifically to an index contract. The most frequent question we receive about products is: how do index costs compare to other options, like a fixed or block and index contract? Energy buyers also ask: how often does an index cost vary? Is an index really a full pass-through of costs? Why or why not?

In this post, we tackle the first 2 questions: what is an index and is it really a full pass-through? and how often do index costs vary? How does it help you manage energy costs?

What is an index contract?

In contrast to the fixed price product, in which businesses basically ask the supplier to accept all the risk of changes in the market price of electricity over the contract term, the index is supposed to be the opposite end of that spectrum.

On an index product, suppliers pass through the actual, market-determined costs to you, the buyer. There are exceptions to this rule of thumb. Some components of an index contract (like ancillary services, capacity, or supplier margin) can, in fact, be fixed. For more information and definitions of these costs, see our Resources section.

Energy on an index. For energy, the supplier will usually invoice you the day-ahead cost of electricity, sometimes suppliers invoice customers the real-time cost.

Remember that energy is the largest component of your cost, so passing day-ahead energy costs through to you means that you are accepting variable price risk.

Capacity, ancillary services on an index. In theory, if you are willing to accept variable price risk, then you should be willing to accept a similar risk on most aspects of costs: ancillaries, capacity, energy, etc. Suppliers can provide you with a fully floating product, with no fixed components (other than supplier margin). Or, suppliers can fix any one of these components (capacity, ancillaries) or several of them.

When you receive a supplier quote for an index product, you may find that their forecast of expected costs (on a unit basis, or based on total expected dollars spent over the course of the contract) does not differ greatly from that of a fixed price. That is technically accurate– because all of the products that you are quoted will be quoted on the same day using the same forward curve to forecast expected costs.

In fact, there can be a range of outcomes for any buyer that chooses an index rate. The expected costs, compared to the high and low risk range will give you an indication of where today’s market is compared to historical prices.

How often can an index price change?

The short, over-simplified answer to this question is that by its nature index energy prices change hourly. So you will never know precisely what you will be paying on your electricity invoice month-to-month. While suppliers typically use the forward curve to forecast costs when you sign your supplier contract, day-ahead and real time costs will vary, and will sometimes vary widely from the expected costs at contract signing.

If you have signed a contract that fixes capacity or ancillary service costs, you will not see any variability in how those costs are billed and invoiced. However, if you have opted to take the market rate for capacity and ancillaries will vary. For ancillaries, you should expect costs to vary hourly. Capacity is a seasonal market and will vary depending on the time of year (Winter vs. Summer). Summer capacity costs are higher than Winter capacity costs, since our system hits its peak in Summer.

How variable is an index product month-to-month? Over a 12 month term?

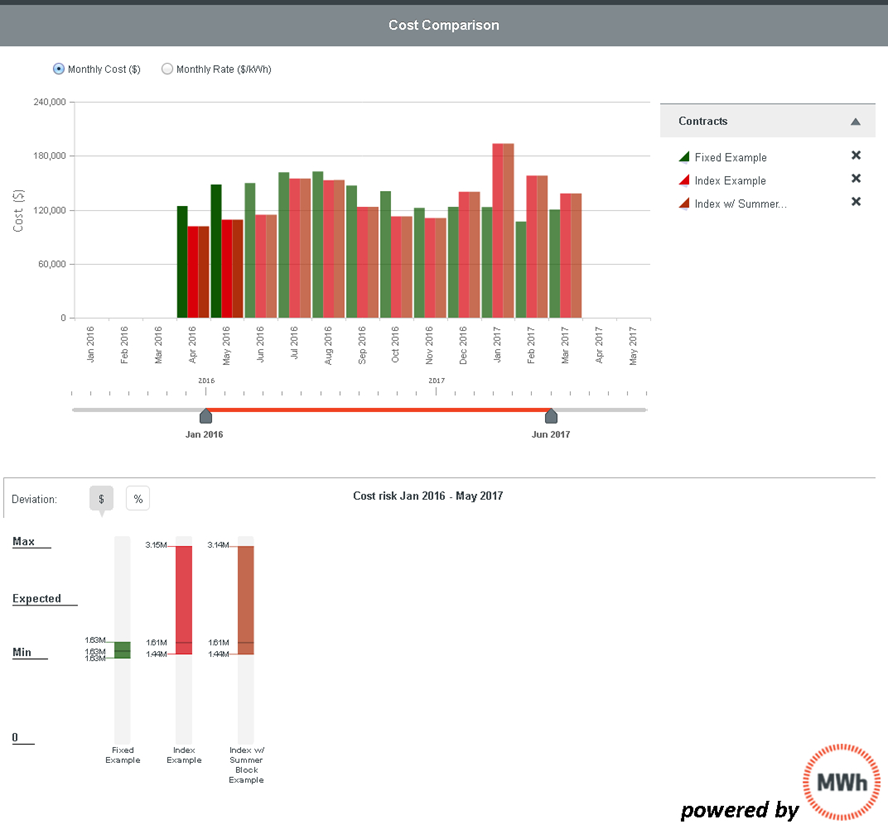

The following graphic compares monthly expected costs, as well as the term expected costs (along with a high and low risk range) for an index (red), block and index (brown), and fixed product (green). Compare expected costs to the high and low risk ranges (in the graph on the bottom, which shows term expected costs for each product). Also note that you are typically more at risk for high cost impacts from an index contract in the Winter, when markets have been most volatile and high priced of late.

Why opt for an index product?

Index products are best for energy buyers who can withstand fluctuations in their energy costs. Or, if you are trying to achieve the lowest cost over the long term then an index product is for you.

(You give up price certainty, but you also avoid paying suppliers to take any fixed rate risk.) If you have any concerns about being able to forecast and meet a set budget, then it is probably best to fix some or all components of cost.

If you fix some components of an index rate (ancillaries, capacity), then you will be managing those costs. Keep in mind that ancillaries and capacity are small components of your costs, so you are providing limited cost management if you opt for a fixed adder.

Bottom line for energy buyers: Determine your objectives as an organization, then implement your plan for purchasing gas or electricity. Having a forward view of fixed vs. variable costs can be helpful in formulating your strategy.

Up next: How have index products performed over the past 3 years, compared to a fixed product? Is it true that an index product is always the lowest cost approach?