Just last week, a customer asked why it was that power and natural gas prices did not experience the kind of disruption from Hurricane Harvey that we have seen after other major storms, like Hurricane Katrina, for example.

There are a number of good articles from a range of resources that explain how the dynamics of local demand and supply impacted gas pricing this time around. Central to the overall stability of natural gas (and, consequently, electricity prices) is where natural gas is sourced now compared to a decade ago. Production has evolved since 2005 in such a way as to minimize the price impacts of Gulf-based Hurricanes. See “Hurricanes Harvey and Irma’s Impact on Energy Operations” in Forbes.

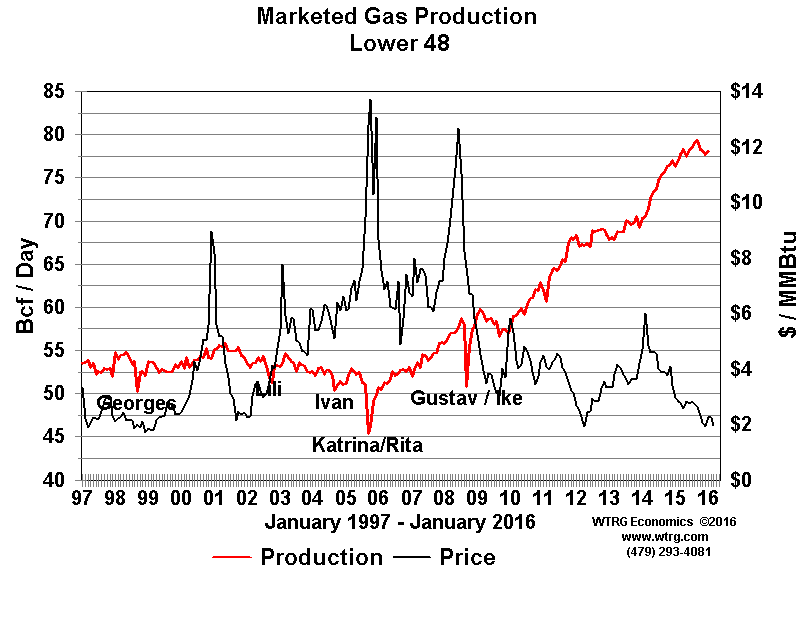

The following two graphs tell the story well. The graphs, from a MarketWatch article titled “The reason hurricanes don’t jolt natural-gas market like they used to” dated April 15, 2016, show how natural gas production has shifted from offshore to the lower 48 states (which includes shale gas production). Offshore gas production, which would likely be impacted by hurricane activity, has significantly declined in the past 2 decades.

Production in the lower 48 states has picked up substantially.

Liam Denning of Bloomberg Gadfly (which claims to be “Fast-paced, data-driven commentary about the most pivotal corporate, financial and market news of the day”) recently published a piece called “Katrina, Rita and Harvey Tell Shale’s Story” that provided a similar view on the significant change brought about by increased onshore natural gas production.

According to Denning:

Hurricane Harvey has struck at a time when energy markets appear indifferent to all sorts of traditional stimuli, especially on the geopolitical front. News of two Libyan oil fields being forced to shut down by armed groups this weekend barely registered in the market.

Whether such a sanguine attitude can last is debatable. But there is no denying it has lasted for a while already, largely because the shale boom has changed both the physical location of U.S. production and expectations about its resilience to both natural and market-made disasters.

If Katrina and Rita helped set off the shale boom, then Harvey should offer proof of the transformation in energy markets they wrought.

Bottom line for finance professionals and energy managers: While it is always important to pay attention to weather and geo-political activities and their impact on energy markets, the transition to onshore production of shale gas has dampened the price volatility traditionally associated with market disruptions.