We have received questions from clients about what to expect from power and gas prices this winter. Good question.

Why do we care about winter energy prices?

Because natural gas and power prices peak in winter, at least in the Northeast. Remember the Polar Vortex? Some energy buyers watched their energy budgets get swallowed up in the first 2 months of 2014, when unusually cold weather gripped the region. A customer’s success at planning and managing energy costs from December to March can have a big impact on meeting and exceeding budget targets.

The last two winters have been relatively uneventful, price-wise, which has helped customers to meet their budgets.

Why haven’t power and gas prices spiked over the last 2 winters?

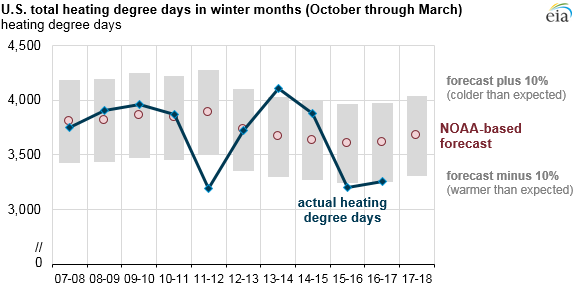

This graphic from the US Energy Information Administration (EIA) is very instructive. Take a look.

The red circles on the graphs show the expected number of heating degree days given the weather forecast. The gray bars represent the range of outcomes with 10% colder temperatures (top end) and 10% warmer temperatures (low end of the gray bar). The blue line shows the actual heating degree days that resulted in each of the winter periods. Note that the last two years, when winter power and gas prices were low, also had lower-than-forecast heating degree days.

What can we expect this winter?

According to the EIA’s short-term energy outlook report, the forecast is for higher energy costs for winter ’17/’18 due to both colder temperatures and higher prices. Natural gas, of greatest concern for most customers, is expected to be 12% more expensive this year than last and 6% higher compared to the last five-year winter average. There is uncertainty that may mean you don’t pay 12%, or that you pay more than 12% more. Your actual costs and expectations for those costs will depend on:

- Your actual usage

- What plans you’ve already put in place to manage energy cost risk

- Where your facility is located

- Your energy cost management strategy.

What should you do now to prepare for winter?

Call us if you’d like to discuss your strategy and expectations for winter. We would be happy to provide you with feedback.

[maxbutton id=”5″ text=”Talk with us about what you should expect to pay this winter” ]

One additional concern that we would have if we were managing costs, and expectations, of colleagues is that the last 2 mild winters have lulled people into a kind of cost and usage complacency. There seems to be a general expectation that we have arrived at a time of low power and gas costs, and that since we have recently experienced relatively little volatility and low costs, those trends are destined to continue. Don’t let yourselves or your colleagues be lulled into this sense of complacency.

There are a number of actions you can take now to prepare for winter ’17/’18. These include: clearly understanding and communicating your budget objectives and strategy (your company’s risk profile); getting a thorough understanding of how much exposure you and your organization have to winter index prices; understanding your options for reducing risk.

Bottom line for energy buyers and finance professionals: While the expectation for this winter is for colder temperatures and potentially higher costs, there are rational steps that professionals can take to managing risk and setting internal expectations. As former Redskins coach Joe Gibbs said, “A winning effort begins with preparation.”

[maxbutton id=”6″ ]