Once again, NY capacity markets are in flux. For some of the history of capacity pricing and markets in New York, take a look at prior articles here, here and here. In any case, it is time for an update on capacity. Capacity costs will impact your energy budget forecasting and 2022-2025 costs. In this post, we describe the market dynamics that impact capacity costs.

Before we get into the details, here’s a reminder about what capacity is:

The Independent System Operator (ISO) administers a market for installed generation capacity. The ISO market insures that, over the long run, adequate generation resources are available to supply load (the aggregate demand for electric supply). To get a handle on the resources needed to meet this demand, the ISO assigns each electric account a capacity obligation.

Each retail electricity supplier in the State must then purchase installed capacity to meet the sum of all the obligations. Annual and/or monthly auctions set capacity prices, with different generators committing to meet certain capacity needs in certain zones for the time periods and at the prices they bid. The generators in turn pass these costs on to their customers. Customers will see this cost on their bills as a specific, separate charge, and it will likely be the second largest component of your total electricity cost. (There is no installed capacity obligation or cost in ERCOT.)

Essentially, as this paper titled “A Dynamic Analysis of a Demand Curve-Based Capacity Market Proposal: The PJM Reliability Pricing Model” states, “The installed capacity (ICAP) markets in the northeastern US markets are a response to this need for additional incentives to construct generation.”

Demand shifts in NYC and across the State ultimately impact NY capacity markets and costs

In the winter of 2021, the NY ISO released their forecast of peak load and required minimum zonal installed capacity for NY City and for other NY Zones. The Summer 2021 forecast for New Yor City’s peak load was down compared to the prior year. This decline in both peak load expectations and locational installed capacity requirements is largely due to the demand destruction attributable to the Covid-19 pandemic. A significant driver of peak load is office building air conditioning. Commercial office space in NY City has not rebounded to pre-pandemic levels. According to the NY Times, 19% of all Manhattan office space does not have a tenant, and even in “occupied” commercial office space the majority of workers haven’t returned full-time as of yet. All of this is unprecedented.

On the other hand, thanks to the increase in remote work and the change in occupancy patterns, demand on Long Island and in Westchester increased.

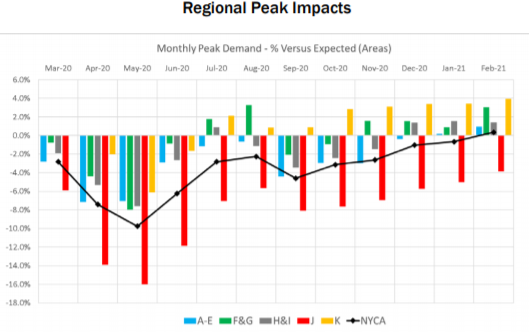

As you can see in the above graph, peak load declined in NYC (red bars) due to changes in occupancy during Covid. Other regions experienced peak demand increases (for example Long Island, in yellow, starting in July of 2020).

NY ISO changes the capacity demand curve

Keep in mind that a demand curve is a line, or curve that shows how much capacity the market demands at various price points. The NY ISO periodically resets the capacity demand curve. When it resets the demand curve, the ISO considers the location of available capacity, the total capacity required in-zone and the statewide installed reserve margin (IRM). Vir Chahal of Berkeley Research Group provides a good summary of the causes and impacts of the demand curve change, as well as the resulting capacity price impacts.

In addition to the reduced Zone J (NYC) demand forecast, there were several other factors that ultimately had an impact on NY capacity prices. Included in these factors were: an increase in transfer capability between Zones G and H and into Zones J/K; an increase in the statewide installed reserve margin (IRM); the decline in the statewide net cost of new entry (net CONE*).

Impact of the new demand curve on capacity prices in all zones

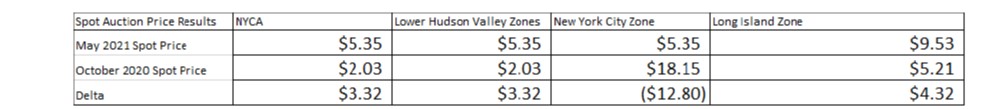

In order for the NY ISO to achieve one of its primary goals — maintaining reliable electric supply across the State — it needs to balance the output of upstate electricity generating resources with that of generators downstate. In doing this for 2021, the ISO effectively increased the value of upstate capacity by increasing the statewide installed reserve margin (IRM) and by also increasing the transfer capability between the Lower Hudson Valley Zone and Zones J/K. Take a look at the following table, which compares the May 2021 spot capacity prices in all zones to the same spot price in October 2020. The NY City Zone saw an almost $13 decrease in the cost of capacity. All other Zones saw a substantial increase.

The key takeaway for purchasers is to pay careful attention to the small print on your supplier contracts. Any uncertainty in pricing or major shift in dynamics creates market uncertainty, and suppliers don’t like uncertainty. They may well try to pass some of the risk associated with this uncertainty on to their customers. While some risk mitigation may be appropriate, it is important to insist on transparency related to this cost and risk.

Bottomline for businesses:

Pay attention to capacity costs as well as to your all-in energy cost. As you would expect, any uncertainty about market rules or future pricing can create challenges for both suppliers and customers. This uncertainty can create an opportunity for suppliers to shift risk back to you, the buyer. It is imperative that you make sure that you have transparency into how your supplier will manage this cost risk.

Will your supplier pass through any additional costs that result from these changes? If so, will you be able to see, track and verify any cost changes easily? What happens if your actual costs are lower than forecast by your supplier? Will you benefit? Make sure you read the fine print in your contract.

And let us know if you have questions.

*Net cost of new entry (net CONE)–Projected annual net energy and ancillary services (EAS) revenues of each peaking plant are another key input to the determination of the ICAP Demand Curves. Once the cost of a peaking plant and the estimated net EAS revenue earnings are established, subtracting the net EAS revenues from the cost of the peaking plant yields the annual reference value (ARV), commonly referred to as the “net cost of new entry (net CONE).”

**The Installed Reserve Margin (IRM) is basically a buffer of additional capacity that the ISO adds on to their best estimate of capacity needs in each zone. It is typically on the order of 20% of their estimated capacity requirements, but varies by zone/region. A higher IRM may reflect a conservative posture by the ISO regarding the appropriate level of capacity, given the unusual experience associated with the pandemic, and the uncertainty this creates for the system as a whole.