What is happening in energy markets?

The answer is: it depends what day you’re asking. The critical point to take away is that energy markets have grown extremely volatile. Experts believe that volatility is here to stay. Commercial and industrial customers have been asking us where we think markets are heading. If we knew, we might just be retired by now.

In late November 2022, Francesco Starace, the CEO of global energy firm Enel, had this to say:

“The turbulence we’re going to have will remain — it might change a little bit, the pattern, but we’re looking at one or two years of extreme volatility in the energy markets.” (Source: CNBC, “Energy markets are facing ‘one or two years of extreme volatility,’ Enel CEO says, Nov 29, 2022 )

Natural gas markets reached an 18 month low in early January 2023, only to rally shortly after due to an expected return to normal Winter temperatures later in the month. According to the US Energy Information Agency, looking at Bloomberg data,

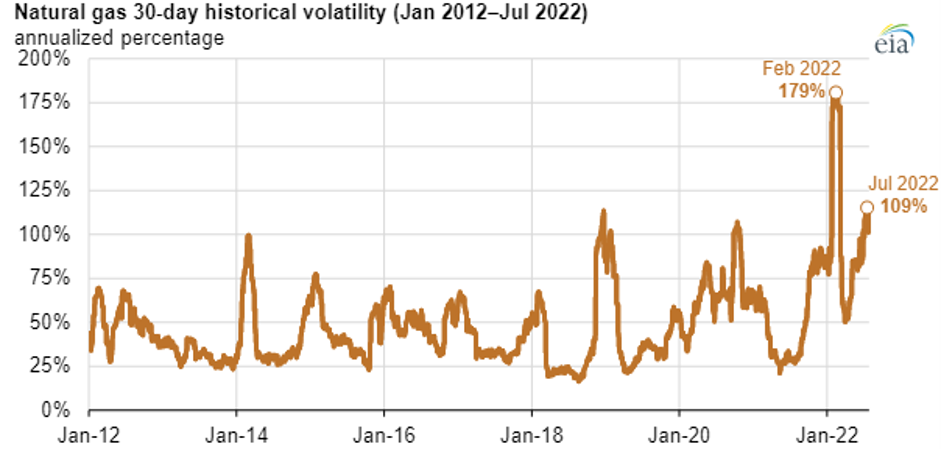

“U.S. natural gas price volatility (a measure of daily price changes) reached its highest level in 20 years, hitting record highs in the first quarter (January–March) of 2022. The 30-day historical volatility of U.S. natural gas prices, which is based on the U.S. benchmark Henry Hub front-month futures price, averaged 179% in February compared with 57% during the first quarter of 2021.

Historical volatility is a measure of daily closing price changes for a commodity at a specific time in the past. During July, historical volatility was lower on a percentage basis, in part, because natural gas prices were relatively higher than during the first quarter of this year.” (Source: US EIA “U.S. natural gas price saw record volatility in the first quarter of 2022,” August 24th, 2022).

Energy markets have experienced significant volatility over the past 12 months

After nearly a decade of relative calm, volatility has returned to power and gas markets

How should you navigate volatile energy markets?

Don’t Panic. The only way to manage through this kind of volatility is to access information and data, especially since we’re likely to see these market dynamics for months, maybe years, to come.

Late in 2014, Roger Martin described one rationale for volatility in mature markets. He wrote in the Harvard Business Review blog titled The Dark Side of Efficient Markets that efficient markets are often volatile…

In the natural evolution of markets, as markets become more efficient, they turn from being use-driven to expectations-driven — like equities, real estate, or derivatives based on both.

For this reason, the unintended consequence of efficiency is price volatility…..Efficient, expectations-driven markets shift quickly for two reasons. First, expectations, unlike uses, have no bounds. They are the product of human imagination, which is ruled alternatively by fear and euphoria. There is simply no limit to how far and how fast expectations can shift. Every bubble and crash reinforces this…. Second, expectations extend deep into the imagined future….So efficiency doesn’t inherently produce smoothness and stability in prices; it produces spikiness, the dark side of efficiency and expectations (The Dark Side of Efficient Markets by Roger L. Martin, Harvard Business Review, October 15, 2014).

So when customers and prospects ask us where markets are headed, we generally advise them to stop trying to make predictions. Instead,

- Ensure that your business objectives are clear.

- Get access to transparent information about markets.

- Set realistic budgetary and operational goals based on clear, transparent information.

- Be prepared to move quickly. These markets favor consistent, dispassionate decision making to achieve clearly stated goals and to effectively manage risk.

Bottomline for businesses: Look for continued spikiness and volatility in energy markets. Learn to manage through volatility. As an informed, efficient market participant, you should be able to use volatility to your advantage. If you do not feel you have access to the tools you need to take advantage of volatile markets, schedule a call with us. We’d be happy to update you.