Reverse auctions explained

From time-to-time we hear about energy buyers who have conducted a reverse auction to procure their power or natural gas. They often feel really good when they’ve just completed the auction. It is gratifying to watch suppliers compete for your business in a declining clock auction. Buyers usually feel as if they’ve gotten a great deal. Have they? The answer is, it depends. And, if they did get a great deal, they may or may not know how that deal has held up over time.

Given the continued interest in this approach, we are re-posting our review of the reverse auction as an energy cost management strategy.

Given the continued interest in this approach, we are re-posting our review of the reverse auction as an energy cost management strategy.

An energy auction, or reverse auction, is a service that is run by an online auction platform, of which there are several. The auction platform posts information about a customer’s electricity or gas supply needs.

A number of suppliers join the auction platform in order to bid for the right to serve a customer’s supply portfolio. The auction platform picks a day in which to run your auction for your electricity or gas load. On that day, at an appointed time, the platform opens the bidding process and suppliers begin posting bids for your business. Usually, the customer and the auction platform agree on contract terms and the product type in advance. The suppliers continue bidding during a specified period of time. It can be exciting to watch as the supplier’s prices improve during the bidding process.

How do customers pay auction platforms?

The winning supplier will add the auction platform’s fee to your supply bill. That auction platform fee, usually per unit (per kWh or therm), is added to any broker fee you may be paying. The fee, of course, is an added charge embedded in your supplier invoice. The basic value proposition of an auction is that you get better pricing if suppliers are competing in real time.

John DuPont of EnerNOC, an energy software, demand response and procurement consulting business, wrote an article in which he advocates for the reverse auction approach as a way for buyers to ensure that they are purchasing at the lowest possible price:

Reverse auctions build on the traditional procurement approach of developing a Request for Proposals (RFP) and soliciting bids from energy suppliers to be evaluated at a specific point in time. Rather than offering one opportunity for each supplier to put in their best bid, the RFP for an energy auction will invite a large number of suppliers to participate in a live event, where they can see the current bids being offered to the customer by other suppliers…. Because the final bids are received in the closing seconds of the auctions, suppliers don’t usually have a chance to see whether their bid is the lowest price offered to the buyer. In about 25% of auctions, one supplier will beat their own best bid just to ensure they win the business!

Pros & Cons of auctions as an energy cost management strategy?

Pros:

The principal benefit of a reverse auction is that it makes the bidding process completely open and transparent. If an organization has to strictly comply with a set of bidding rules, reverse auctions can be helpful in delivering on that requirement.

In addition, the online auction provides an impression of value. It gives buyers the feeling that they are getting the lowest possible price, as well as price transparency. Whether this value is actually delivered depends on your ability, as a customer, to verify bid prices against a reference or market price. It also largely depends on how you schedule your reverse auction and what happens to power and gas markets after you run the auction.

Cons:

In our various prior roles at energy supply companies, we have had experience bidding on customer business using a reverse auction. In addition, here at MWh, we have worked with clients who have bid on reverse auctions for their electricity and gas supply.

Here are some of the pitfalls we have observed when clients used an auction platform to secure electricity supply.

In short, it is difficult to get objective data that suggests that you will get a better price through an auction than if you simply ran a thorough RFP process.

Here’s why:

- Retail margins are very slim, and suppliers can’t price a commodity below market to win business in a reverse auction. So while the optics may be great to you, the buyer, suppliers just add extra margin to their starting bid and then drop their price down toward a normal margin as the auction progresses.

- You won’t know whether you’re getting a good deal without access to your own pricing model. The only way to verify that you are getting the “lowest price” is to know what the forward market price is, and, ultimately, what a reasonable delivered retail price should be. Auction platforms do not show you the actual market price, they only show you the relative prices of a set of bidders, and how those have moved over the time window of the auction. That information is not a meaningful measure of a discount or of savings.

- Remember that while an auction process might be suitable when the only product you seek is a full requirements fixed price, other products such as index with adder or index with energy blocks usually cannot be accurately compared based on any single bid value.

- Finally, when you purchase your supply using an auction platform, you pay for that service throughout the term of your contract in the form of a fee added to the supplier bill. While it may be convenient to use an auction service, if you are going to pay 0.5-1.0% of your supply costs for a service, you should make sure that the service continues to add verifiable value throughout the term of the contract, not just on one day of the year.

Bottom line for businesses.

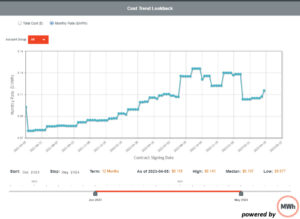

More meaningful savings can result from running an RFP for your electricity supply at the right time for your business. Selecting the right time to buy (based on a transparent forward energy price curve) can shave 7-15%– and is much more likely to deliver value than an auction held on an arbitrary day (see the graph, left). In short, you should get a similar pricing benefit when you purchase through a well-managed RFP, with careful specification of the product term sheets used in the solicitation process.

If you believe that you will benefit from using an auction platform, make sure you have a view of the forward market and access to a pricing model so you can verify that you are getting a competitive price from bidding suppliers. Make sure that you have the ability to re-bid at any time—and make sure that you can compare price offers from suppliers on an apples-to-apples basis. Don’t let the use of an auction platform limit your ability to get the right product for your business at the right time.