Energy markets and the power grid are in transition in New York State and, really, across the country. Many states have made a commitment to phase out fossil fuel power generation over time. Even in states where this is not the case, our power grid is likely to transition away from traditional fossil fuels over the next several decades. The implications of this transition are significant for customers. Over the past year, we have begun to see the impact of grid transition on energy and power markets. This transition directly affects you. In this post, we will describe the recent events in New York State and how this grid transition is likely to affect an important aspect of our electric system: reliability.

What you need to know

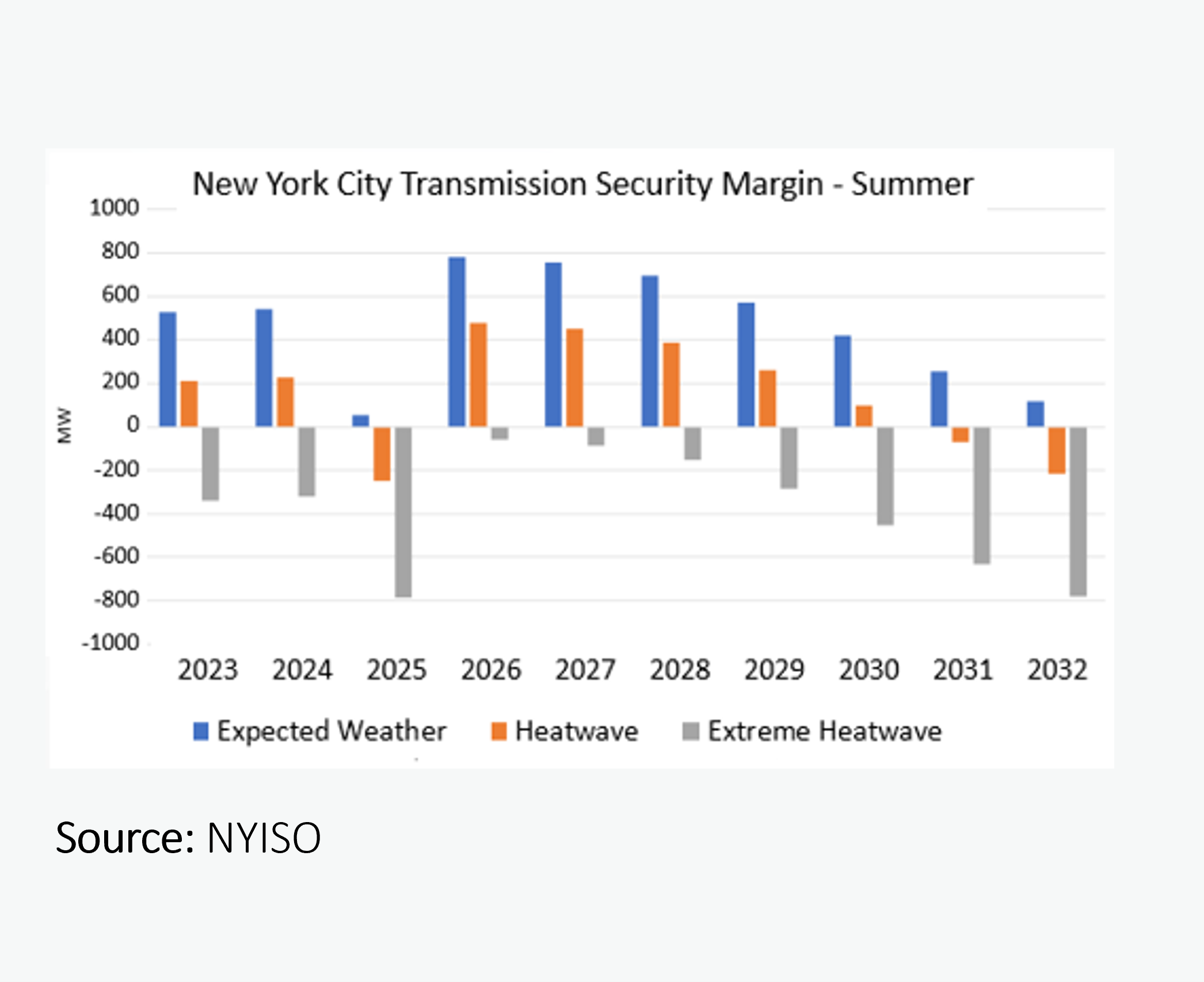

The NY Independent System Operator (NYISO) releases a quarterly STAR Report which focuses on short term reliability needs over the next five years. As of last Spring, New York City’s zone or Zone J is expected to be deficient by 446 MW in 2025 during a nine hour period on peak days. The ISO attributes this shortfall to power plant retirement (including the so-called “gas peaker rule” adopted by the state), new transmissions plans and load forecasts. Beginning May 1st, 2025, an additional 590 MW of combustion turbines or “peakers” are expected to become unavailable and therefore the NYISO was concerned that New York City would experience capacity shortfalls.

Make an energy plan now

Don’t get caught without a plan.

Understand energy markets and how they impact your business.

Make markets work for you.

Get access

How will the NYISO respond to the projected generation shortfall, and its impact on reliability?

On August 4th, 2023, the NYISO issued a solicitation requesting solutions to address the identified shortfall in the reliability margin. Under the NYISO’s guidelines, the proposed solution had to, individually or in combination have met the stated shortfall of 446 MW. If no solutions met their criteria, the NYISO had the right to supplement with temporary solutions. In response to the solicitation, the NYISO received a transmission solution from Con Edison and a “Reliability Must-Run” (RMR) generator solution from one provider.

According to an article in Utility Dive, the NYISO consulted with Con Edison to find additional transmission or non-transmission solutions for 2025. Con Edison and the ISO and could not identify any additional projects that would reliably meet the need. With the exception of one battery storage solution that did not mean the full stated shortfall, developers proposed no other market-based solutions.

The ISO concluded that, for now, there is only one option that will allow for New York to meet demand in the next five years and that is maintaining 4 temporary gas peakers in operation. While these four generators were expected to be retired in May 2025, their operation will extend May 2027 so as to ensure a reliable, functioning power grid in NYC. contribute a total of 508 MW.

What does this mean for customers?

We have reported here frequently that the energy transition is likely to result in greater volatility and more dynamic markets for customers. For additional background on the likely causes of volatility take a look at this post. We’ve said this before, we will say it again. Energy buyers who plan ahead benefit the most. Think of it this way: you, the business energy consumer, will always be buying power and gas for as long as you are in business. That means that you should always be planning ahead–not a few weeks or months in advance, but quarters and even years in advance. Understand the current and future market prices and how they move. Volatility can work for you if you have access to good information. No matter where you get information, make sure it is current and updated at least quarterly.

Bottom line for energy buyers and financial decision makers: Energy consumers need to pay frequent attention to the dynamics of energy markets, no matter where you are located. Use data and analytics to navigate complexity and be proactive.

the megawatt hour

Hedging

How to clarify your objectives and employ hedging effectively

- Understand hedging misconceptions

- Clarify the right strategy for your business

- Communicate your objectives clearly

Free Download

Understand the risks, myths and rewards of hedging energy and fuels.

GET INSIDER INFORMATION ABOUT ENERGY

Are you interested in understanding energy from an insider’s perspective?

Then, sign up for our newsletter. You’ll love it!

We don’t spam and we don’t share your email.