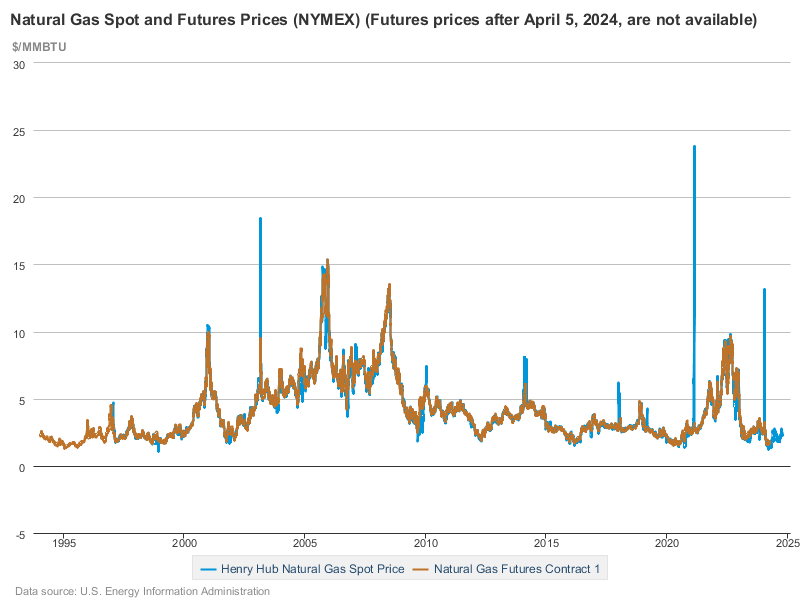

Forward markets for power and natural gas in NY State and beyond are characterized by extreme volatility and uncertainty. Within the last week, we have seen a $3 to $5/MWh drop in on-peak and off-peak power prices in NY City to a non-weighted average forward price of $51.37/MWh (or $.05137/kWh). A year ago, the same strip of power was closer to $64/MWh. These price declines have largely been driven by a drop in natural gas prices and a determination that NY State is well-positioned to manage winter demand.

Make an energy plan now

Don’t get caught without a plan.

Understand energy markets and how they impact your business.

Make markets work for you.

Get access

What’s driving this recent forward market decline?

- We are in the so-called “shoulder season” between high demand summer and winter periods.

- Natural gas storage is robust, expected cuts in production have not fully materialized and demand destruction from recent hurricanes has altered the supply-demand dynamic.

- Temperatures are mild; demand resulting from cooler temperatures and the onset of heating season has been delayed.

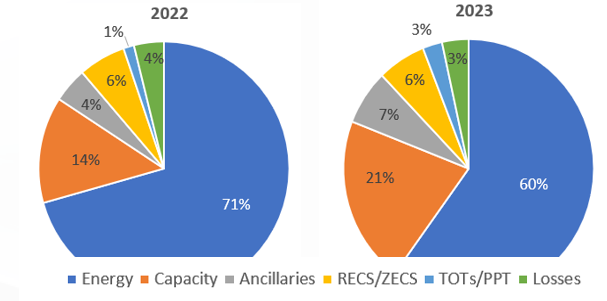

Keep in mind that energy is just one component of your total cost.

As NY State continues to prioritize a transition away from fossil fuels, we will find that non-energy price components will continue to increase. These cost components, like capacity and ancillary services support capacity building and investment in reliability.

Caption: While energy (in blue) continues to be the principal driver of customer costs, capacity and ancillary services have become larger components of energy costs. Source: NYISO

Bottomline for finance and energy professionals. Strategies for managing your energy costs will vary based on client priority and market perspective. In order to make the most of volatility, instead of being simply subject to it, it is important to be ready to act quickly on market movements like the ones we are observing now. Data, information and transparency are critical to developing and implementing appropriate strategies for your business.

the megawatt hour

Hedging

How to clarify your objectives and employ hedging effectively

- Understand hedging misconceptions

- Clarify the right strategy for your business

- Communicate your objectives clearly

Free Download

Understand the risks, myths and rewards of hedging energy and fuels.

GET INSIDER INFORMATION ABOUT ENERGY

Are you interested in understanding energy from an insider’s perspective?

Then, sign up for our newsletter. You’ll love it!

We don’t spam and we don’t share your email.