Lately, we have received a lot of questions about the effectiveness of energy auctions (reverse auctions). An energy auction, or reverse auction, is a service that is run by an online auction platform, of which there are several. The auction platform posts information about a customer’s electricity or gas supply needs, and then recruits suppliers to bid for the right to serve that customer’s supply portfolio. The auction platform picks a day in which to run your auction for your electricity or gas load. On that day, at an appointed time, the platform opens the bidding process and suppliers begin posting bids for your business. Usually, the contract terms and the product type have been decided in advance. The suppliers continue bidding during a specified period of time, and it is not uncommon to see bids improving (i.e. suppliers reducing their prices) during the bidding process.

Lately, we have received a lot of questions about the effectiveness of energy auctions (reverse auctions). An energy auction, or reverse auction, is a service that is run by an online auction platform, of which there are several. The auction platform posts information about a customer’s electricity or gas supply needs, and then recruits suppliers to bid for the right to serve that customer’s supply portfolio. The auction platform picks a day in which to run your auction for your electricity or gas load. On that day, at an appointed time, the platform opens the bidding process and suppliers begin posting bids for your business. Usually, the contract terms and the product type have been decided in advance. The suppliers continue bidding during a specified period of time, and it is not uncommon to see bids improving (i.e. suppliers reducing their prices) during the bidding process.

The auction platform charges a fee, usually per kWh, that is added to the winning supplier’s bid and then paid to the auction platform by the supplier as an added charge embedded in your supplier invoice. The value proposition of an auction is that you get better pricing if suppliers are competing in real time.

A 2007 article in E-Source’s Corporate Energy Manager Consortium titled “Energy Procurement—eBay Style” talks about the mechanics and proposed benefits of online auctions.

Pros:

The principle benefit, as the article suggests, is “to document the procurement process for both Sarbanes-Oxley and GAAP compliance” (p. 2). In addition, the online auction provides an impression of value, it gives buyers the impression that they are getting the lowest possible price, as well as price transparency. Whether this value is actually delivered depends on your ability, as a customer, to verify bid prices against a reference or market price.

Cons:

We have bid on on-line auctions in previous roles at energy supply companies. Here are some of the pitfalls we have observed when clients used an auction platform to secure electricity supply.

As one of the individuals in the E-Source article mentions, it is difficult to get objective data that suggests that you will get a better price through an auction than if you simply ran a thorough RFP process. Here’s why:

- Retail margins are very slim, and suppliers can’t price a commodity below market to win business in a reverse auction. So while the optics may be great to you, the buyer, suppliers just add extra margin to their starting bid and then drop their price down toward a normal margin as the auction progresses.

- When you add in the cost of the auction (payment to the auction platform), which is rarely priced in a transparent way, it becomes less likely that the auction produces savings for the buyer.

- You won’t know whether you’re getting a good deal without access to your own pricing model. The only way to verify that you are getting the “lowest price” is to know what the forward market price is, and, ultimately, what a reasonable delivered retail price should be. Auction platforms do not show you the actual market price, they only show you the relative prices of a set of bidders, and how those have moved over the time window of the auction. That information is not a meaningful measure of a discount or of savings.

- Remember that while an auction process might be suitable when the only product you seek is a full requirements fixed price, other products such as index with adder or index with energy blocks usually cannot be accurately compared based on any single bid value.

- Finally, when you purchase your supply using an auction platform, you pay for that service throughout the term of your contract in the form of a fee added to the supplier bill. While it may be convenient to use an auction service, if you are going to pay 0.5-1.0% of your supply costs for a service, you should make sure that the service continues to add verifiable value throughout the term of the contract, not just on one day of the year.

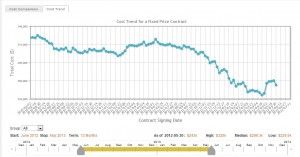

More meaningful savings can result from running an RFP for your electricity supply at the right time for your business. Selecting the right time to buy (based on a transparent forward energy price curve) can shave 7-15%– and is much more likely to deliver value than an auction held on an arbitrary day (see the graph above). In short, you should get a similar pricing benefit when you purchase through a well-managed RFP, with careful specification of the product term sheets used in the solicitation process.

If you believe that you will benefit from using an auction platform, make sure you have a view of the forward market and access to a pricing model so you can verify that you are getting a competitive price from bidding suppliers. Make sure that you have the ability to re-bid at any time—and make sure that you can compare price offers from suppliers on an apples-to-apples basis. Don’t let the use of an auction platform limit your ability to get the right product for your business at the right time.