Gas prices are up higher than they’ve ever been. Historic highs. That’s what we’re talking about here. Fuel cost spikes like these cause a great deal of volatility in gas and power markets. There has been an impact on both the forward and day-ahead markets.

Here’s a story that gives you a sense for the precedent-setting market prices. A story in Reuters reports the following:

When computer coders at the Intercontinental Exchange (ICE) built a platform for trading natural gas in 2001, they only allowed space for two-digit entries. With gas around $5 per million British thermal units, prices above $99 just didn’t seem feasible.

A freezing start to 2014 changed all that….On average, gas on the Transco line in New York sold for $120 on Tuesday, breaking the $55 record set on Jan. 6.

The stated reason for this run-up is a lack of pipeline capacity—also from Reuters:

The United States has ample supplies of gas, but the price spikes reflect a recurring conundrum: A lack of pipelines to take gas from major supply centers to market. This bottleneck pushes prices higher during periods of high demand like the first few weeks of this year.

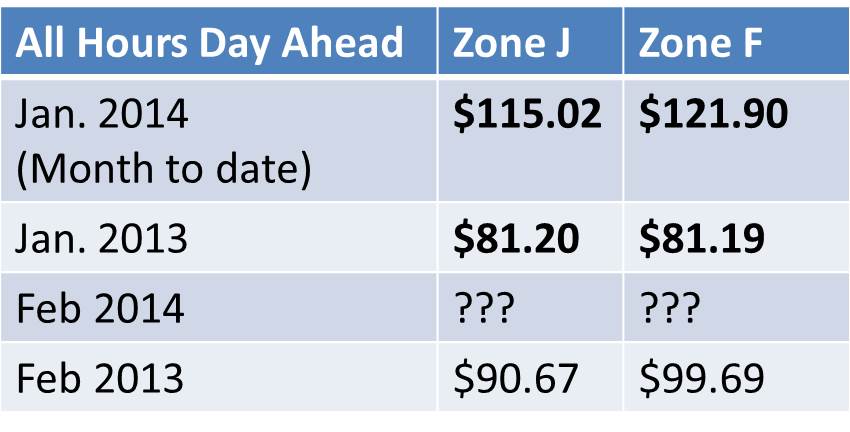

First, day-ahead markets. A year ago, day-ahead (index) markets reached all-time high levels due to supply constraints that hit New England. This year, so far, we are seeing similar trends. Day ahead prices so far have been even higher this year than last. Take a look at the following chart to see what we’re talking about:

For those customers that are on an indexed rate, you may well see high prices continue through February. For those of you who are on utility default rates, you may not see the high prices immediately, but should prepare for high adjustment rates that will flow through in the next three months

Those of you who are on an index rate shouldn’t do any panicky buying—it is too late to switch to a fixed price for the Winter months—and it would appear that forward markets for the Winter months have reached such high levels that you would simply be locking in the same high rates that you would pay on an index anyway.

Forward markets. As we relayed in December, forward markets for electricity purchases in January and February have reached recent highs. Much of this run-up is due to two factors: a) anticipation of a colder Winter than we’ve experienced in recent years; b) traders and energy speculators have made the most of the colder weather and have taken positions that would allow them to take advantage of the colder weather and the New England supply constraints that we describe above. Speculators are in a position to take advantage of this run-up—and capitalize on these market changes. Just for context, last year and the year before saw record-low energy forward prices starting in late December and early January. Customers who locked in electricity prices during that time frame (Jan-Feb 2013) for contracts that started in the Spring and extended a year or more ended up buying electricity at the 12 month low.

The graph, below, compares a 12 month strip for NYC power if you bought last January (2012) as compared to a 12 month strip if you bought for NYC on January 15, 2014. The difference in delivered price cost to you, the business, is more than 12%.

Bottomline for businesses: So what do we recommend? We suggest that anyone who has a near term energy contract expiration wait.. don’t buy now. But be prepared to see high bills for January, and perhaps for February as well. The ample supply available suggests that there will be a correction.