The Megawatt Hour- Energy Management – Energy Information

MWh Cost Management Process

Hedging: How to clarify your objectives and employ hedging effectively

February 28, 2019

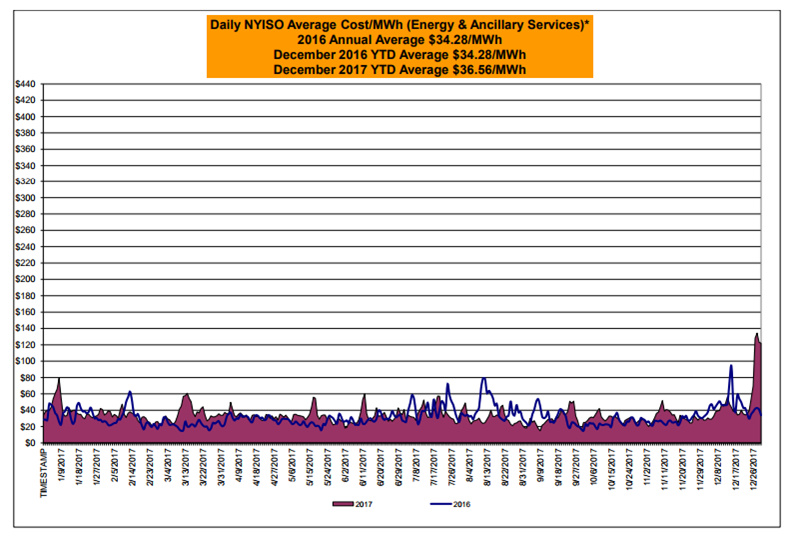

Index energy markets: Volatility & what it means to you

January 17, 2018

Benchmarking: How to track energy cost management progress?

December 15, 2016

Winter 2017: Why are the markets so squirrely?

November 14, 2016

Budget planning for effective energy cost management

October 31, 2016

What contract term length is best? Energy cost management questions

September 26, 2016

Why MWh?

September 19, 2016

Market Dynamics: Gas

January 31, 2016